Weekly Forex Market Outlook: Inflation Data, Central Bank Speeches & Key Trading Levels to Watch

By CheckTheTrend.com Analytic Team

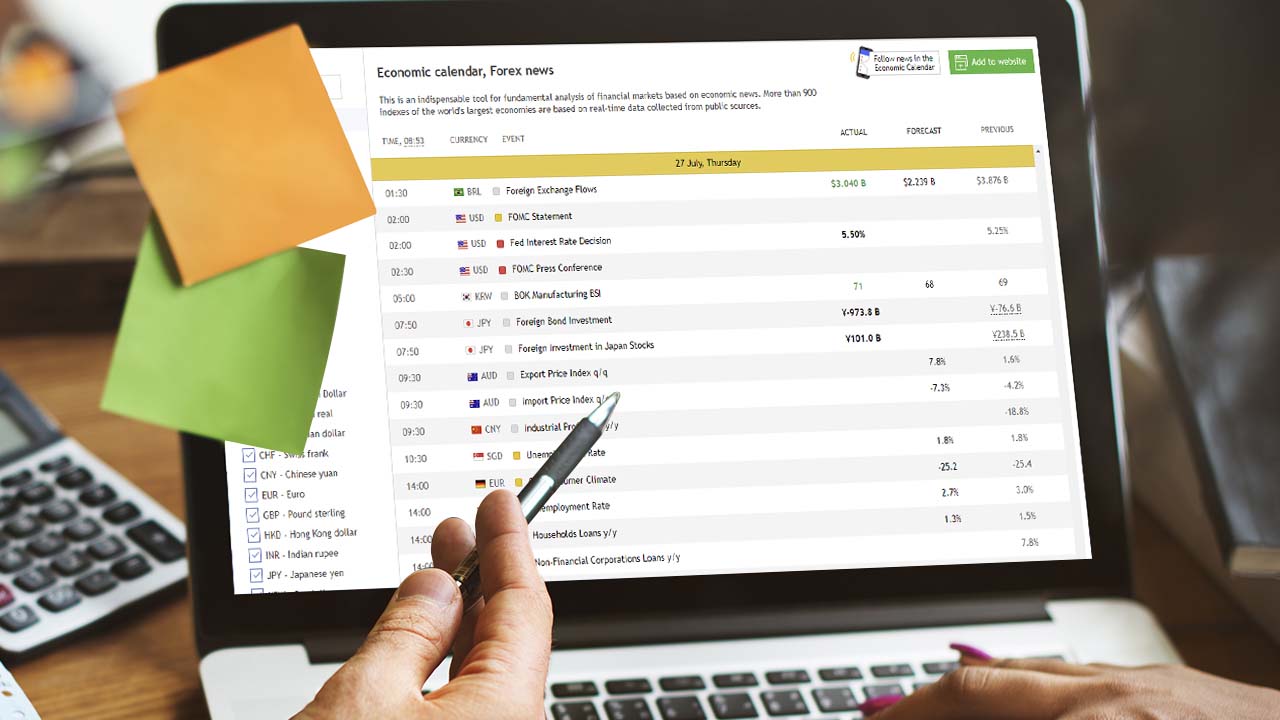

Global markets has entered the final week of February with a packed economic calendar from Forex Factory. Traders are preparing for inflation updates, heavy Federal Reserve commentary, ECB speeches, and key GDP confirmations that could trigger volatility across forex, commodities, and indices.

Here’s your complete optimized weekly market outlook breakdown for Feb 22-28, including macro analysis, geopolitical context, corporate sentiment, and technical outlook.

📅 1. Economic Data Releases — What may be Moving the Markets This Week

US inflation expectations are set to be a primary market driver for the week of February 22–28, as traders closely monitor price data and Federal Reserve commentary for clues on the next policy move. Even in the absence of a major CPI release early in the week, related indicators such as Producer Price Index (PPI), consumer confidence, and Fed speeches can shape inflation expectations. If inflation pressures appear to be cooling, markets may interpret that as supportive for risk assets like equities and cryptocurrencies, while the U.S. dollar could soften. Conversely, any upside surprise in inflation-related data would likely strengthen the dollar and push Treasury yields higher, as investors reassess the possibility of prolonged restrictive monetary policy.

Currency markets are particularly sensitive to inflation signals because they directly influence interest rate differentials. A hotter-than-expected inflation reading would reinforce a hawkish stance from the Federal Reserve, potentially boosting USD pairs such as USD/JPY and pressuring EUR/USD and GBP/USD. On the other hand, signs that inflation is stabilizing or trending lower could fuel speculation about future rate cuts later in 2026, weakening the dollar and supporting gold prices. Gold (XAU/USD) often reacts inversely to real yields, so softer inflation data could trigger renewed buying interest above key psychological levels.

Equity markets will also respond to inflation dynamics this week. Lower inflation tends to support stock indices like the S&P 500 and NASDAQ by easing pressure on corporate borrowing costs and improving valuation outlooks. However, persistent inflation could spark renewed volatility, especially in growth and technology stocks that are sensitive to interest rate expectations. Overall, for the week of February 22–28, inflation remains the central macro theme: any shift in pricing pressures will ripple across forex, commodities, and equities, setting the tone for broader market sentiment. Check Market Calendar

🟢 Sunday (Feb 22)

🇳🇿 NZD Retail Sales q/q

- Retail Sales: 0.6% (below 1.9% forecast)

- Core Retail Sales: 0.4% (below 1.2% forecast)

📌 Market Reaction:

The weaker-than-expected consumer spending data may pressure NZD pairs early in the week, particularly NZD/USD and NZD/JPY.

Low liquidity due to Asian bank holidays may amplify early volatility.

🇳🇿 New Zealand Retail Sales Underperform — What It Means for NZD

The latest New Zealand Retail Sales q/q data showed headline spending at 0.6%, markedly below the 1.9% forecast, while Core Retail Sales — which strips out volatile items — came in at 0.4% versus a 1.2% expected gain. Retail sales are one of the broadest gauges of consumer demand, accounting for a large portion of the nation’s economic activity. When both headline and core figures undershoot expectations, it signals that households are spending less than anticipated, which can weigh on overall GDP growth. You can view the raw release and historical trends on the official Stats NZ website here: https://www.stats.govt.nz/information-releases/retail-trade-survey-december-2025

📌 Why it matters: Sluggish retail activity suggests that inflationary pressures could ease as demand softens — a dynamic the Reserve Bank of New Zealand closely monitors when setting monetary policy. Persistent weakness in consumer spending increases the odds of slower rate hikes or even future easing if growth stalls.

📉 Immediate FX Market Reaction — NZD Likely to Weaken

The softer-than-expected figures put downward pressure on NZD pairs right after release, particularly NZD/USD and NZD/JPY. Markets interpret disappointing consumption data as a sign that the RBNZ might delay tightening or hold policy steady longer than previously thought, which reduces yield appeal and undercuts the currency’s strength.

This isn’t just theoretical — forex traders use economic calendars like the one on Forex Factory to anticipate such scenarios: https://www.forexfactory.com/calendar?week=feb22.2026

In practical terms:

- NZD/USD may slip against the U.S. dollar as traders price in weaker growth prospects.

- NZD/JPY could fall even if the yen is slightly softer, because the carry advantage of NZD shrinks.

Lower retail sales can also affect NZD risk sentiment, which tends to bleed into commodities and equities that correlate with economic demand.

📊 Liquidity Conditions May Amplify Moves Early in the Week

Adding to this technical picture is the fact that key Asian financial centers, including China and Japan, observed bank holidays around this release window. Reduced participation from institutional players during holidays generally leads to thinner liquidity, meaning that even modest flows can create outsized price swings.

Bloomberg’s FX volatility indicators often show that low-liquidity environments tend to exaggerate reactions to economic surprises — especially for smaller currencies like the NZD. You can see FX volatility trends and trading conditions here:

https://www.bloomberg.com/markets/currencies

👉 Key takeaway: During the first part of the week, NZD pairs may experience elevated volatility and sharper directional moves as markets adjust positions on this fundamental retail data, particularly given the absence of heavy institutional activity during regional holidays.

🟡 Monday (Feb 23)

🇩🇪 German Ifo Business Climate

A key sentiment indicator for the Eurozone economy.

🇺🇸 US Factory Orders (-0.4%)

Suggests cooling manufacturing momentum.

🎙 ECB President Lagarde Speaks

🎙 FOMC Member Waller Speaks

Speeches from:

- European Central Bank

- Federal Reserve

📌 Market Sensitivity: EUR/USD volatility likely during Lagarde’s remarks. USD pairs sensitive to Fed tone.

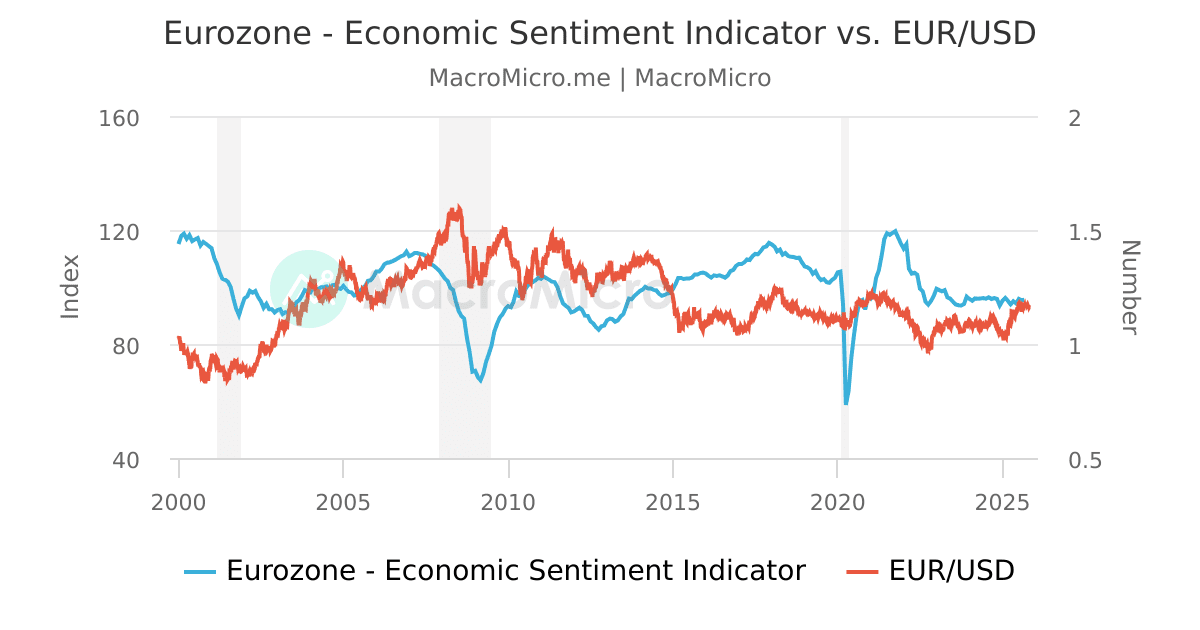

🇩🇪 German Ifo Business Climate — European Sentiment Gauge

4

The German Ifo Business Climate Index is released weekly and serves as one of the earliest forward-looking indicators of business sentiment in Europe’s largest economy. It combines responses from thousands of firms in manufacturing, services, construction, and retail to measure how companies perceive current conditions and expectations for the next six months. A rise in the index suggests improving economic momentum, while a fall implies that firms are turning cautious. You can view the official Ifo release and historical dataset directly on the Ifo Institute’s site here: https://www.ifo.de/en/survey/business-climate

📌 Why it matters: Because Germany is the largest economy in the European Central Bank (ECB) zone, its business climate often sets the tone for broader euro-area growth expectations. Improved sentiment can support the EUR, whereas deterioration tends to elevate recession risk pricing.

🇺🇸 US Factory Orders Point to Cooling Manufacturing Activity

Alongside European sentiment, the release of U.S. Factory Orders — which came in at -0.4% in the latest reporting period — is another important data point suggesting softening momentum in industrial production and capital goods demand. This dataset tracks the total value of new orders for manufactured goods and is a key input for GDP forecasting models. The full release and historical data are published by the U.S. Census Bureau here: https://www.census.gov/economic-indicators/factory-orders.html

📌 Market implication: Weak factory orders can signal slowing economic expansion in the U.S., which may temper expectations for future interest rate increases by the Federal Reserve. Slower manufacturing can also drag on equities and commodity demand.

🎙 Central Bank Speeches — Lagarde and Waller in Focus

This week also features scheduled speeches from:

- **European Central Bank President Christine Lagarde

- Federal Reserve FOMC member Christopher Waller

Speeches from central bank policymakers are market events in their own right, often guiding expectations for future policy decisions on interest rates, asset purchases, and economic outlook. While the speeches themselves don’t carry immediate policy changes, they are scrutinized for hawkish vs. dovish tone shifts.

- Lagarde’s comments may affect how traders price EUR/USD, especially if she signals caution about inflation or underscores risks to European growth.

- Waller’s remarks will be parsed for clues on U.S. rate path expectations and inflation tolerance, potentially moving USD-related pairs like USD/JPY, USD/CAD, and broader risk sentiment.

External sources that track central bank speak schedules and sentiment include the Federal Reserve calendar (https://www.federalreserve.gov/monetarypolicy.htm) and ECB communication logs (https://www.ecb.europa.eu/press/key/date/html/index.en.html).

📌 Market Sensitivity Snapshot — Volatility Ahead

Because this mix combines hard economic data with policy commentary, financial markets — especially the FX space — may experience heightened volatility:

- EUR/USD is particularly sensitive during Lagarde’s remarks because it reflects both eurozone economic health and monetary policy bias.

- USD pairs often react strongly to Fed rhetoric, as traders adjust expectations for future rate decisions based on inflation, growth, and labor market signals.

In summary, the interplay between sentiment indicators, real economy data, and central bank communication this week creates a fertile setup for directional moves — not just in forex, but also in bond yields and equity indices.

🔵 Tuesday (Feb 24)

This is a high-density Fed commentary day.

Speakers include multiple FOMC members — markets will analyze any shift in rate outlook.

🇺🇸 ADP Employment Change

Precursor to NFP-style sentiment.

🇦🇺 Australian CPI y/y (3.7%)

Critical for AUD direction.

🇬🇧 BoE Monetary Policy Hearings

Watch signals from the Bank of England.

📌 Expect volatility in AUD/USD, GBP/USD, and USD index.

📊 High-Density Macro & Policy Day — What Traders Need to Know

This part of the week features multiple high-impact events clustered into one trading session, meaning markets could see sharp movements across currencies, equities, and interest rates. The combination of Fed commentary, labor indicators, inflation data, and central bank policy hearings means that traders need to stay alert to both fundamentals and real-time price reactions.

🇺🇸 ADP Employment Change — A Leading Jobs Indicator

The ADP National Employment Report measures private-sector payroll changes and is often viewed as an early precursor to the more influential U.S. Nonfarm Payrolls (NFP). While ADP isn’t a perfect predictor, strong or weak ADP prints tend to influence market expectations for labor market strength.

🔗 Source & Data: https://adpemploymentreport.com

📌 Market Impact:

- A stronger-than-expected ADP reading can bolster the U.S. dollar as traders price in continued economic strength.

- A weak reading may weigh on USD pairs and raise speculation around softer domestic demand.

Given the upcoming speeches from Federal Reserve officials, ADP’s signal could reinforce — or contradict — the tone set by policymakers.

🇦🇺 Australian CPI — Inflation Still Front and Center

The latest Australia CPI y/y released at 3.7% highlights ongoing inflation pressures in the country’s economy. CPI (Consumer Price Index) is one of the most critical macro indicators because it informs central banks about price stability and cost-of-living trends.

🔗 Source (ABS Australian CPI Overview): https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation

📌 AUD Market Reaction:

- Higher inflation supports the case for further tightening by the Reserve Bank of Australia, potentially boosting AUD/USD and AUD crosses.

- Lower inflation could push traders toward easing bets, weakening the Aussie dollar.

Because Australia’s economy is export-oriented, inflation readings also impact commodity prices (e.g., iron ore, gold), which in turn circulate back into AUD sentiment.

🇬🇧 Bank of England Monetary Policy Hearings

The Bank of England Monetary Policy Committee (MPC) hearings are formal opportunities for members to discuss economic conditions, inflation expectations, and interest rate considerations in a structured setting.

🔗 BoE MPC Hearings Info: https://www.bankofengland.co.uk/monetary-policy/monetary-policy-committee-hearings

📌 GBP Implications:

- Dovish commentary may soften GBP/USD and other sterling crosses.

- Hawkish nuance can strengthen the pound, especially if wage growth and core inflation remain elevated.

These hearings often reveal nuanced views behind policy decisions that don’t show up in headline rate announcements alone — making them a must-watch for FX traders.

📌 Market Sensitivity — Volatility Ahead

This confluence of events sets up heightened volatility in key markets, particularly:

📈 AUD/USD — reacts to Australian inflation and cross-market risk sentiment

📈 GBP/USD — sensitive to BoE policy nuances

📈 USD Index (DXY) — reflects combined USD strength/weakness from ADP, Fed comments, and relative growth outlooks

Because these releases and policy speeches cluster together, prices may move quickly and sharply — often before the fundamental implications are fully understood. That’s why many traders use economic calendars such as the one on Forex Factory to time entries and manage risk around news: https://www.forexfactory.com/calendar?week=feb22.2026

🔍 Strategic Trading Tips for the Session

- Wait for initial price reaction before entering — first moves can be noisy.

- Use tight stop-losses around major announcements.

- Watch for correlation shifts (e.g., AUD rising even if USD softens) — this often signals broader sentiment changes.

🔴 Wednesday (Feb 25)

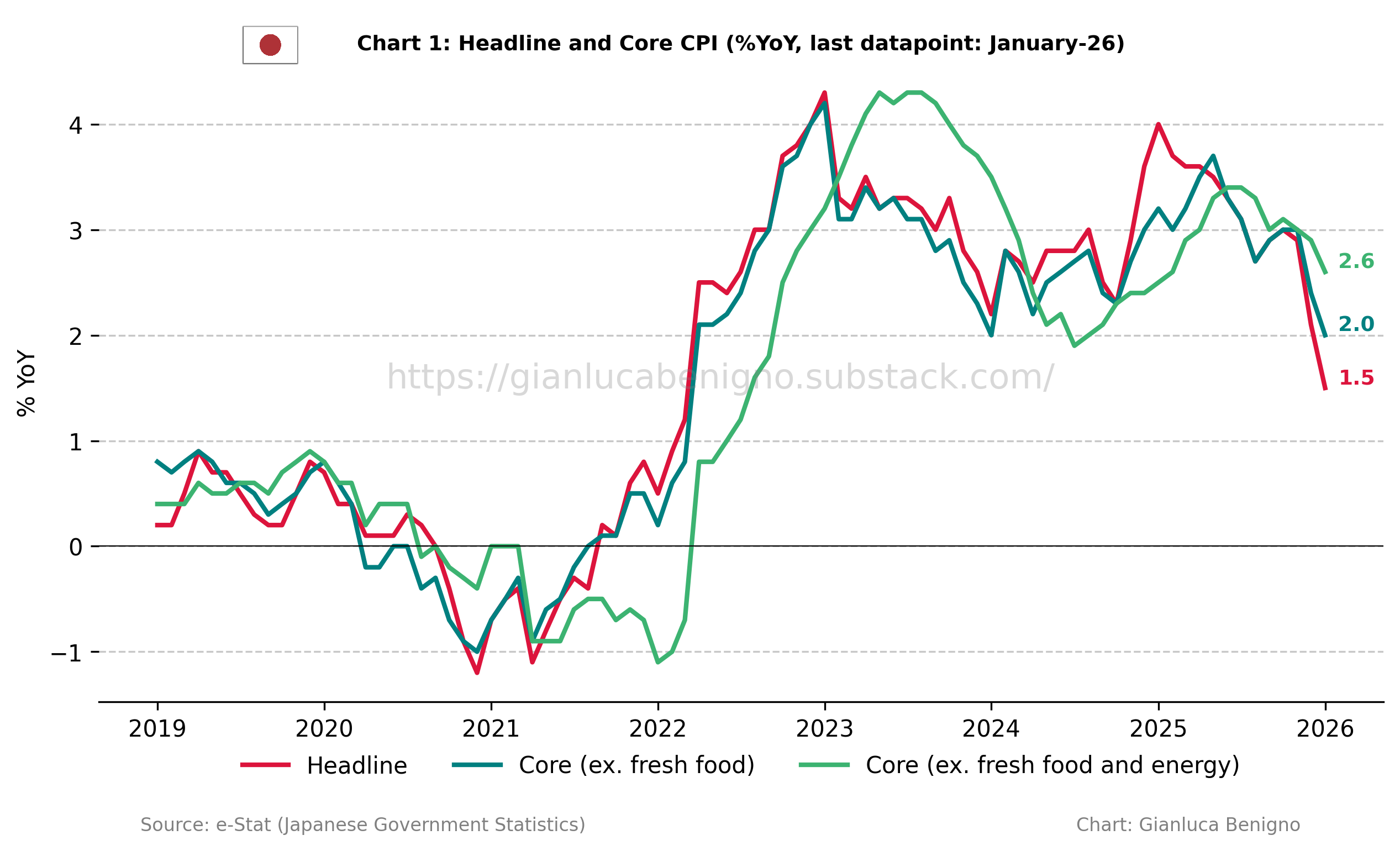

🇯🇵 BOJ Core CPI y/y (1.9%)

Relevant for yield curve speculation from the Bank of Japan.

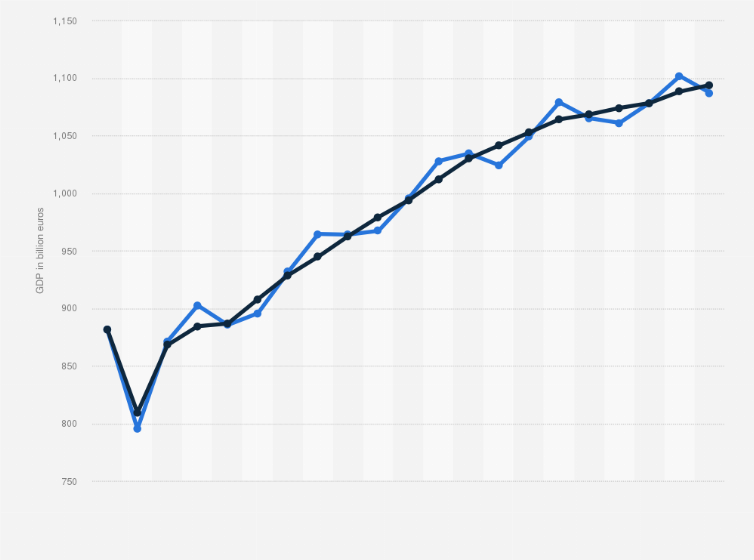

🇩🇪 German Final GDP q/q (0.3%)

🇺🇸 US Crude Oil Inventories

Direct impact on WTI and energy stocks.

📌 Oil traders and CAD pairs should monitor inventory data closely.

🇯🇵 Japan Core CPI y/y (1.9%) — Why It Matters for the Global Markets

Japan’s Core Consumer Price Index (CPI) y/y, reported at 1.9%, remains one of the most closely watched inflation gauges for both currency and bond markets. Unlike headline CPI, core CPI excludes fresh food prices, providing a clearer view of underlying inflation trends — a key consideration for the Bank of Japan (BoJ). Official Japan CPI data and methodology can be accessed via the Statistics Bureau of Japan: https://www.stat.go.jp/english/data/cpi

📌 Market Impact

- Yield Curve Speculation:

Core inflation near the BoJ’s long-standing 2% target fuels debate over future adjustments to monetary policy, including potential changes to yield curve control (YCC). Stronger inflation readings can prompt traders to price in steeper yield curves — meaning higher long-term Japanese Government Bond (JGB) yields — which normally strengthens the yen (JPY). - FX Reaction:

If inflation continues to grind higher, markets may begin discounting eventual BoJ tightening, boosting JPY crosses such as USD/JPY and EUR/JPY.

Higher real yields and inflation expectations also tend to lift interest rate differentials, which are key drivers of currency flows.

External reference: Japan CPI official release data — https://www.stat.go.jp/english/data/cpi

🇩🇪 German Final GDP q/q (0.3%) — Growth Confirmation for the Eurozone

The German Final GDP q/q reading of 0.3% confirms the growth trajectory of Europe’s largest economy. Germany’s Federal Statistical Office, Destatis, publishes this GDP data along with revisions to earlier figures — you can view the official dataset here: https://www.destatis.de/EN/Home/_node.html

📌 Market Impact

- EUR Sentiment:

A positive GDP figure supports the narrative that economic activity in the eurozone remains resilient, providing strength to the euro (EUR). This can feed into broader euro currency pairs like EUR/USD and EUR/GBP. - ECB Policy Expectations:

While the European Central Bank doesn’t set policy based on a single data point, stronger growth readings reduce speculation about near-term rate cuts, bolstering risk assets tied to European economic performance.

External reference: German GDP official announcements — https://www.destatis.de/EN/Home/_node.html

🇺🇸 US Crude Oil Inventories — Immediate Impact on Commodities & Currencies

Weekly US Crude Oil Inventories figures — released by the U.S. Energy Information Administration (EIA) — show changes in commercial crude stockpiles. You can access the official weekly petroleum status report and historical data here:

📌 Market Impact

- WTI & Energy Stocks:

When crude inventories fall more than expected, it often signals strong demand or tighter supply, which tends to lift West Texas Intermediate (WTI) prices. Conversely, larger-than-expected inventory builds typically weigh on prices and energy stocks. - Currency Pairs (CAD, AUD):

Because Canada is a major oil exporter, USD/CAD and other CAD crosses often move in correlation with oil price swings. Stronger oil prices generally support CAD, while weaker oil pushes USD/CAD higher. - Risk Asset Sentiment:

Energy sector performance also impacts broader stock indices, especially those with higher energy sector exposures like the S&P 500.

EIA weekly petroleum status reports

📌 What Traders Should Watch This Week

Each of these events carries distinct implications:

🔥 JPY pairs — inflation data reshaping BoJ outlook

📈 EUR crosses — growth data bolstering euro positioning

🛢 WTI & CAD FX pairs — inventories driving short-term moves in commodities and currencies

Because this week brings inflation, growth confirmation, and commodity fundamentals together, traders should manage risk carefully around scheduled releases and price reaction windows.

Use reliable release calendars like Forex Factory to time your entries:

🟣 Thursday (Feb 26)

Another ECB speech day (Lagarde).

🇺🇸 US Unemployment Claims

🇨🇦 CAD Current Account

Broad USD and EUR volatility possible.

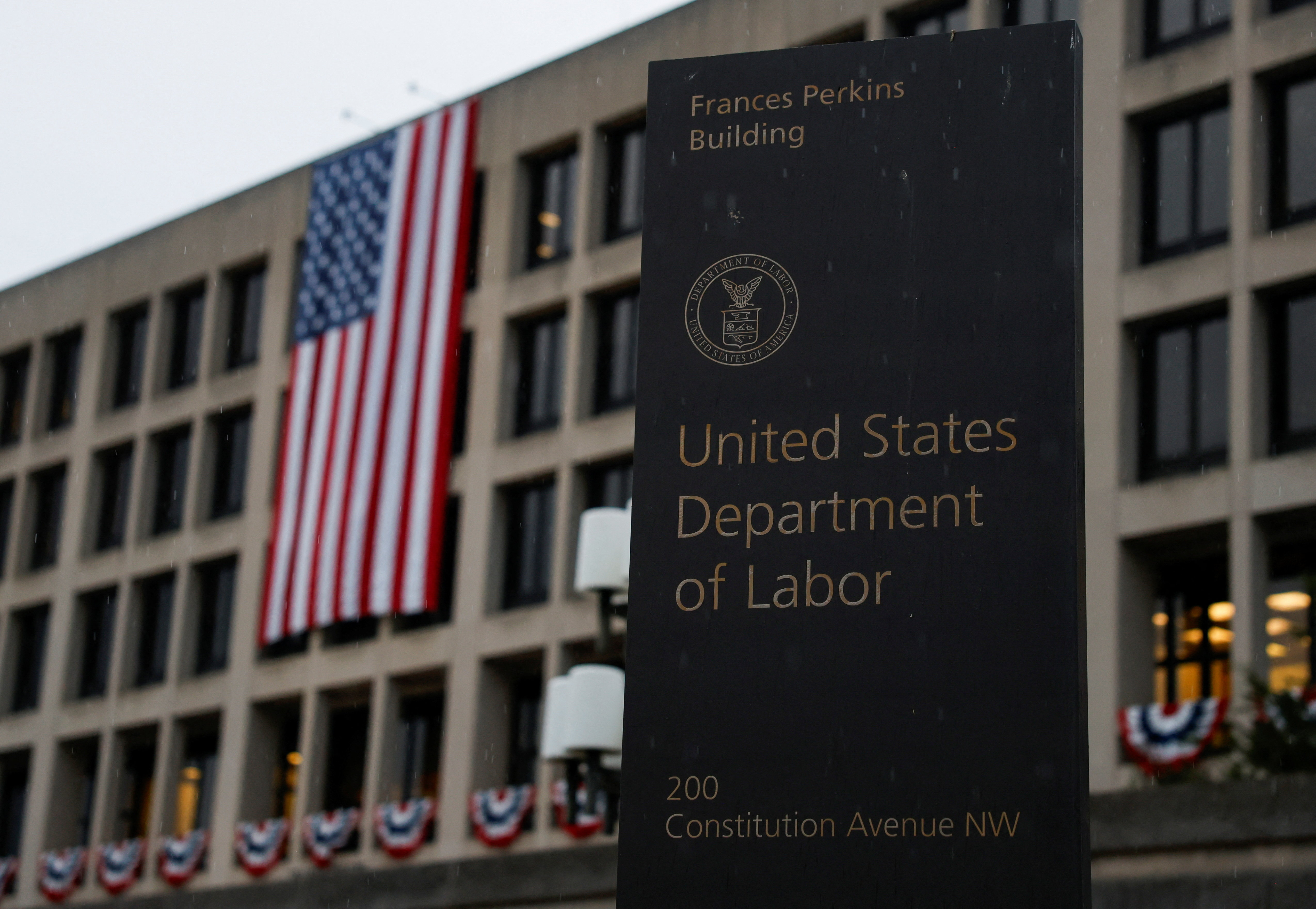

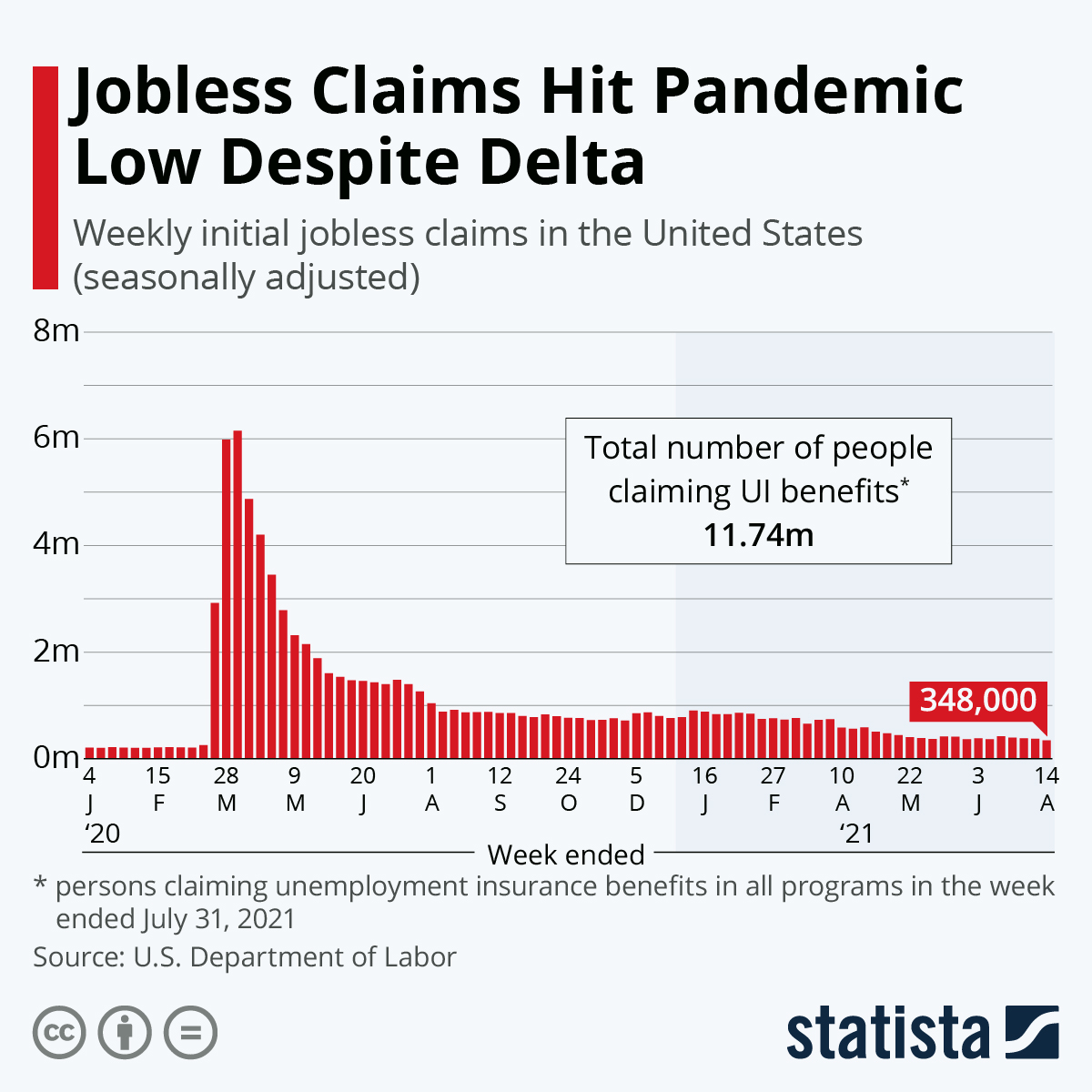

🇺🇸 US Unemployment Claims — First Look at Labor Market Health

A sample chart of weekly US Initial Jobless Claims (illustrative)

The US Unemployment Claims report — also known as Initial Jobless Claims — tracks the number of new filings for unemployment insurance. It is released weekly by the U.S. Department of Labor and acts as a timely, rolling snapshot of labor market momentum:

🔗 Source (U.S. Department of Labor – Unemployment Data):

📌 Market implications:

- Rising claims often signal weakening job market conditions and can weigh on consumer sentiment and equities.

- Falling or low claims support the narrative of a tight labor market, boosting confidence in economic strength and potentially strengthening the U.S. dollar (USD).

Because employment is a major driver of inflation through wage pressures, traders watch unemployment claims as an early indicator of labor-driven price dynamics.

🇨🇦 Canadian Current Account — National Trade and Payments Balance

A representative graphic showing Canadian current account trends (illustrative)

The Current Account measures the difference between a country’s exports and imports of goods, services, income, and current transfers. For Canada, a resource-heavy economy with significant trade exposure, this data helps gauge external demand pressures:

🔗 Source (Statistics Canada – Current Account data):

📌 Market implications:

- A surplus suggests the country exports more than it imports, which can support the Canadian dollar (CAD).

- A deficit indicates a relative weakness in trade performance, which may dampen CAD performance vs various FX pairs like USD/CAD.

Because the Canadian economy is heavily tied to commodities such as oil, the current account — along with crude inventories and prices — is a critical part of the macro picture.

📌 Market Sensitivity — What This Means for USD & EUR Volatility

Given the mix of central bank communication, labor market data, and cross-border trade figures, traders should anticipate a rise in volatility across major markets:

🔥 EUR/USD:

- Lagarde’s comments can move the euro directly, especially if she signals inflation concerns or policy nuance.

🔥 USD Pairs & DXY:

- Strong US labor data may reinforce dollar strength, especially against commodity currencies.

🔥 CAD FX Pairs (USD/CAD, CAD/JPY):

- The Canadian current account result, combined with oil price action, often dictates CAD performance.

Overall, this combination of macro events — particularly when clustered — tends to expand intraday ranges and quicken market reaction times. For reliable scheduling and impact indicators, use dependable calendars like Forex Factory’s weekly schedule:

https://www.forexfactory.com/calendar?week=feb22.2026

🟤 Friday (Feb 27)

🇩🇪 German Prelim CPI

🇺🇸 Chicago PMI

🇺🇸 US PPI

End-of-week inflation tone could shape next week’s positioning.

🏦 2. Central Bank Watch — Policy Direction in Focus

4

This week is dominated by central bank commentary.

🇺🇸 Federal Reserve

Markets are pricing a possible pause narrative if inflation cools.

🇪🇺 ECB

Growth concerns remain while inflation remains sticky.

🇬🇧 BoE

Watching wage pressures and CPI persistence.

🇯🇵 BoJ

Monitoring inflation sustainability before deeper normalization.

📌 Monetary divergence remains the biggest FX driver in 2026.

🌍 3. Geopolitical & Macro Sentiment

4

Markets remain sensitive to:

- Energy supply disruptions

- Trade negotiations

- Political tensions

- Risk sentiment shifts

Oil and Gold remain headline-driven assets.

📊 Technical Analysis Section

4

EUR/USD

- Support: 1.0800

- Resistance: 1.0950

Bullish above 1.0950.

Gold (XAUUSD)

- Support: $1975

- Resistance: $2020

Bullish bias above $2000 psychological zone.

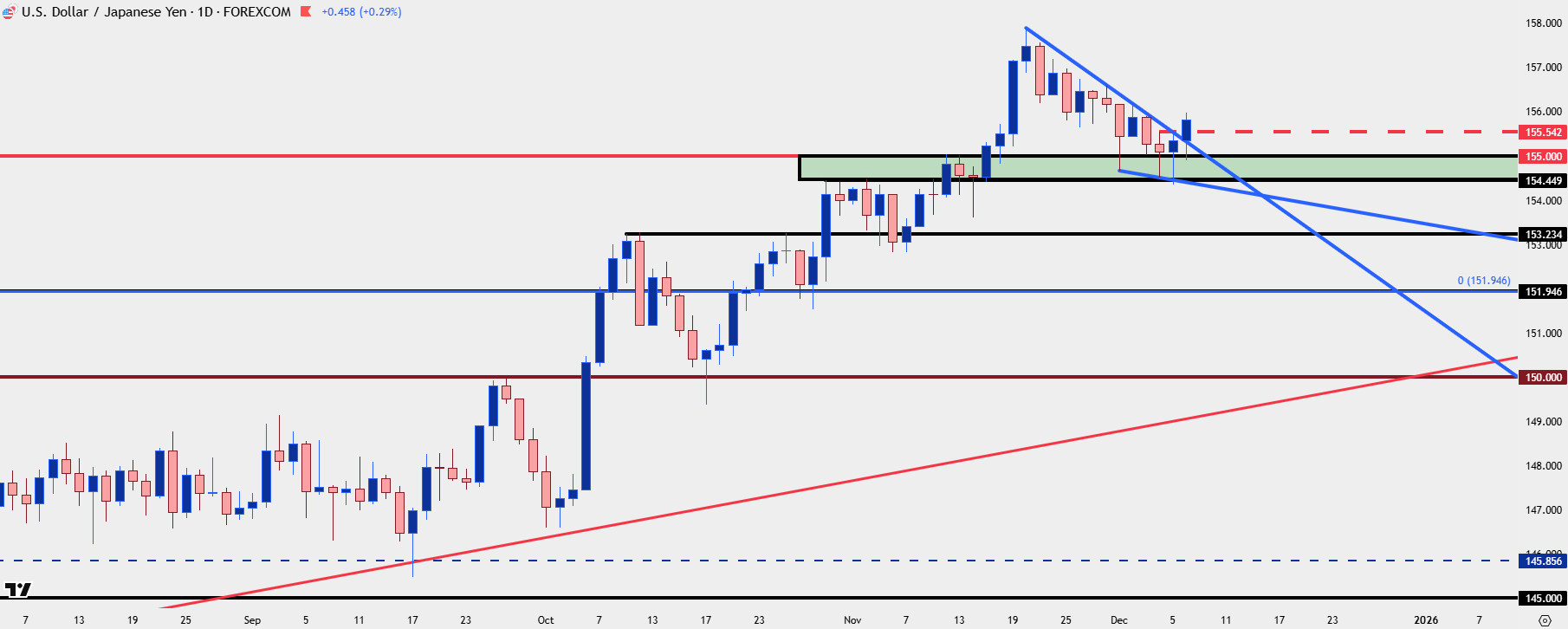

USD/JPY

- Support: 148.50

- Resistance: 150.00

NZD/USD

Weak retail data keeps pressure below 0.6250.

📈 Forecast

🕒 Short-Term (1–3 Days)

Data-driven volatility. Expect spikes around speeches and CPI releases.

🗓 Medium-Term (1–4 Weeks)

Mild risk-on bias if inflation continues moderating.

📊 Long-Term Insight

Markets remain highly sensitive to:

- Rate path expectations

- Liquidity conditions

- Growth outlook divergence

🚨 Market Movers to Watch

- USD Index (DXY)

- Gold

- NASDAQ

- AUD/USD

- EUR/USD

Breakouts likely during high-impact news windows.

- ForexFactory Economic Calendar:

- Federal Reserve Official Site:

- ECB Official Site:

- Bank of England:

- Bank of Japan:

🧠 Final Trading Note

This week combines:

✔ Inflation Data

✔ Heavy Central Bank Speeches

✔ Growth Confirmation Data

✔ Oil & Commodity Sensitivity

The best strategy:

Trade reaction, not prediction. Protect capital around high-impact releases.

As a new trading week begins, global financial markets are positioning around key macroeconomic data, central bank signals, geopolitical risks, and corporate earnings momentum. Using insights from the economic calendar at Forex Factory, here is your structured weekly outlook covering forex, stocks, commodities, and crypto markets.

📅 1. Economic Data Releases This Week

4

This week’s economic calendar features high-impact releases expected to drive volatility across USD pairs, indices, and commodities.

🔹 Inflation Data (CPI / PPI)

- US CPI and Core CPI reports are closely watched.

- If inflation prints lower than forecast → USD may weaken.

- Higher-than-expected inflation → markets may price in tighter policy.

📌 Market Sensitivity: EUR/USD, Gold (XAUUSD), NASDAQ

🔹 Labor Market (NFP / Unemployment Claims)

- Non-Farm Payrolls and jobless claims data will indicate economic strength.

- Strong jobs data → Dollar strength.

- Weak labor market → Risk-off sentiment.

📌 Watch: USDJPY, Dow Jones, Treasury yields

🔹 PMI Surveys (Manufacturing & Services)

- PMI above 50 = expansion.

- Below 50 = contraction.

- China & Eurozone PMI releases may influence commodities and EUR pairs.

📌 Commodities Impact: Oil, Copper

🔹 GDP Updates

- Quarterly GDP revisions could shift medium-term expectations.

- Strong growth = risk-on bias.

- Weak growth = defensive positioning.

🏦 2. Central Bank Watch

4

Major central banks remain cautious amid moderating inflation and uneven growth.

🔹 Federal Reserve (Fed)

- Markets pricing potential rate hold.

- Hawkish tone → USD strength.

- Dovish commentary → Gold & equities rally.

🔹 European Central Bank (ECB)

- Monitoring growth slowdown.

- Any hint of rate cuts → EUR pressure.

🔹 Bank of England (BoE)

- Inflation persistence remains concern.

- GBP volatility expected.

🔹 Bank of Japan (BoJ)

- Yield curve policy remains under scrutiny.

- USDJPY sensitive to policy shifts.

🌍 3. Geopolitical Developments

Geopolitical risk remains a wildcard.

- Energy supply tensions → Oil spikes.

- Trade disputes → Risk-off flows.

- Sanctions or conflict escalation → Safe haven demand (Gold, USD, CHF).

📌 Oil traders should monitor Middle East developments closely.

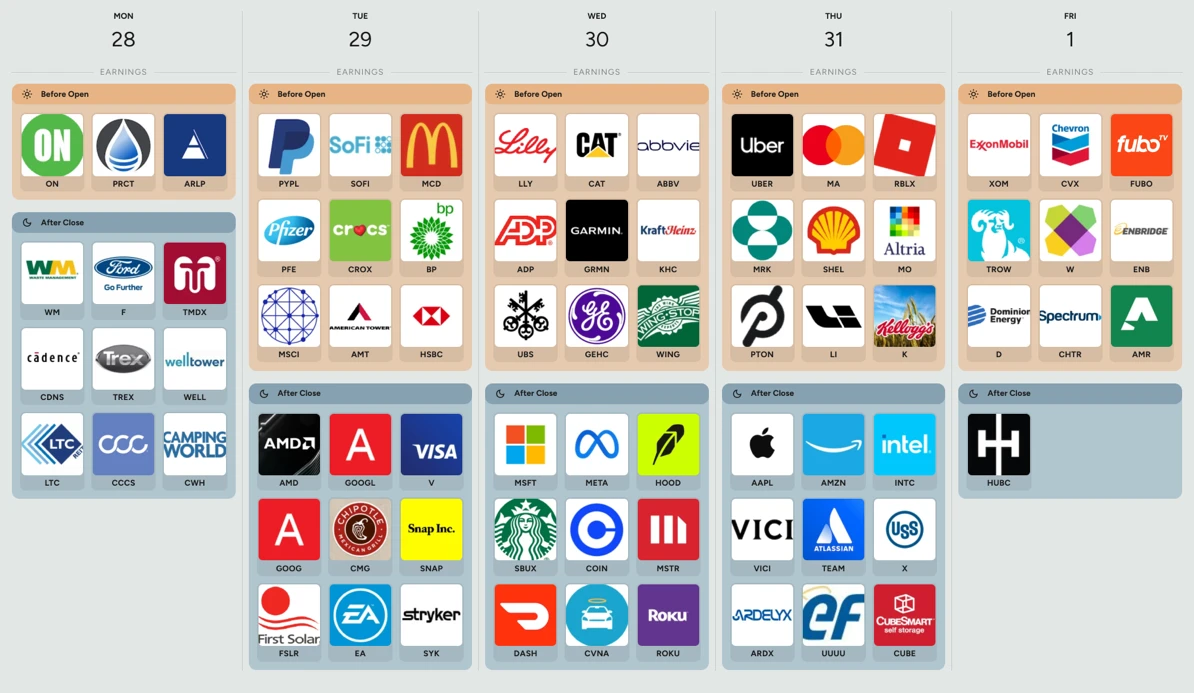

🏢 4. Corporate Earnings & Market Sentiment

4

Earnings season continues to influence index direction.

- Strong tech earnings → NASDAQ upside continuation.

- Revenue misses → Sharp sector rotations.

- Forward guidance matters more than past results.

📌 Watch large-cap earnings for volatility spikes.

🚨 5. Market Movers & Volatility Risks

Sudden breakouts often occur during:

- CPI releases

- NFP data

- Central bank press conferences

- Unexpected geopolitical headlines

Potential scenarios:

- Dow breaks key support → selloff acceleration.

- Bitcoin clears resistance → momentum rally.

- Gold reclaims psychological level → bullish continuation.

📊 Technical Analysis Section

🔹 A. Key Chart Interpretations

4

EUR/USD

- Trading inside range.

- Resistance near 1.0950.

- Support around 1.0800.

Gold (XAUUSD)

- Support: $1975–1985 zone.

- Resistance: $2020.

- Bullish bias above 2000 psychological level.

Bitcoin (BTCUSD)

- Consolidation pattern forming.

- Break above resistance → bullish continuation.

- Below support → correction phase.

🔹 B. Support & Resistance Levels

| Asset | Support | Resistance |

|---|---|---|

| EUR/USD | 1.0800 | 1.0950 |

| Gold | $1975 | $2020 |

| USDJPY | 148.50 | 150.00 |

| NASDAQ | 17,800 | 18,400 |

| Bitcoin | 41,000 | 44,000 |

📈 Weekly Forecast

🕒 Short-Term Outlook (1–3 Days)

Volatile and data-driven. Expect spikes during CPI and labor releases.

🗓️ Medium-Term Outlook (1–4 Weeks)

Mildly bullish equities if inflation continues cooling.

📊 Long-Term Insight

Markets remain sensitive to:

- Rate policy shifts

- Global growth trajectory

- Liquidity conditions

Gold and defensive assets could benefit if economic slowdown deepens.

🇺🇸 US Unemployment Claims — First Look at Labor Market Health

The US Unemployment Claims report — also known as Initial Jobless Claims — tracks the number of new filings for unemployment insurance. It is released weekly by the U.S. Department of Labor and serves as a real-time pulse check on labor market strength.

🔗 Official Source (U.S. Department of Labor – Unemployment Data):

Because it is released weekly (unlike monthly payroll data), it often becomes an early warning signal for shifts in employment trends.

📌 Market Implications

- Rising claims often signal weakening job market conditions. This can reduce consumer spending expectations, pressure equities, and soften the U.S. dollar.

- Falling or persistently low claims reinforce the narrative of a tight labor market, which may support wage growth and inflation — potentially strengthening the USD.

Employment feeds directly into inflation through wage dynamics. If wages remain firm due to tight labor supply, inflationary pressure can persist — something the Federal Reserve watches closely.

For traders, unemployment claims are often treated as a short-term volatility trigger in USD pairs and U.S. bond yields.

🇨🇦 Canadian Current Account — National Trade & External Balance

4

The Canadian Current Account measures the difference between exports and imports of goods, services, income flows, and transfers. It is published by Statistics Canada and provides a broad view of the country’s external financial position.

🔗 Official Source (Statistics Canada – Current Account Data):

https://www150.statcan.gc.ca/n1/en/surveys/71X0011

For a commodity-heavy economy like Canada, this data is particularly important because trade flows are heavily influenced by oil and natural resource exports.

📌 Market Implications

- A current account surplus suggests strong external demand and export performance — typically supportive of the Canadian dollar (CAD).

- A deficit signals weaker trade performance and can dampen CAD strength, particularly against USD.

Because Canada is a major oil exporter, the current account often moves in tandem with crude oil prices. When oil rises and export revenues increase, CAD typically benefits.

📌 Market Sensitivity — USD & EUR Volatility Outlook

4

This event cluster combines:

- Central bank communication (including ECB commentary)

- U.S. labor market data

- Canadian trade balance figures

That mix increases the probability of cross-asset volatility.

🔥 EUR/USD

Lagarde’s tone can directly move the euro, especially if inflation guidance shifts.

🔥 USD Pairs & DXY

Strong U.S. labor data tends to reinforce dollar strength, particularly against commodity currencies.

🔥 CAD FX Pairs (USD/CAD, CAD/JPY)

The Canadian current account, combined with oil price action, often dictates short-term direction.

🧠 Strategic Takeaway

When labor market data, trade balance figures, and central bank communication converge in the same session, markets often expand intraday ranges and react faster than usual.

Professional traders monitor reliable economic calendars like:

https://www.forexfactory.com/calendar?week=feb22.2026

In weeks like this, price action tends to be event-driven rather than purely technical — meaning macro awareness becomes just as important as chart analysis.

🧠 Trading Strategy Focus This Week

- Trade high-impact news with caution.

- Watch liquidity before and after major releases.

- Combine macro analysis with technical structure.

- Protect capital during event volatility.

📌 Conclusion

This week’s economic calendar from Forex Factory suggests a potentially high-volatility trading environment driven by inflation data, labor market reports, central bank commentary, and geopolitical headlines.

Professional traders will focus on:

- Reaction, not prediction.

- Key technical levels.

- Risk management discipline.

Stay tuned for our Daily Market Recap updates throughout the week.