Updated: February 4, 2026

Global financial markets are navigating a mixed but opportunity-rich landscape as investors digest macroeconomic signals, central bank expectations, and shifting risk sentiment. From equities and forex to commodities and crypto, today’s market activity reflects cautious optimism tempered by volatility and upcoming high-impact economic events.

This Daily Global Market Trends report brings together insights from global equities, foreign exchange, commodities, and digital assets to help traders, investors, and market watchers stay ahead.

📊 Executive Market Summary

Markets opened with a cautiously positive tone as U.S. equity futures edged higher, the U.S. dollar showed relative strength, and commodities remained volatile. Risk appetite is being shaped by expectations around monetary policy, inflation data, and global economic indicators scheduled this week.

Key highlights today:

- U.S. equities show modest upside

- USD maintains broad strength

- Gold rebounds on safe-haven demand

- Oil remains range-bound

- Crypto markets consolidate under risk-off sentiment

📈 Market Snapshot (All Asset Classes)

| Asset Class | Current Trend | Market Driver |

|---|---|---|

| U.S. Stocks | Mildly Bullish | Stable earnings outlook, macro anticipation |

| European Stocks | Mixed | Sector rotation, cautious sentiment |

| Forex (USD) | Strong | Fed policy expectations |

| Gold | Rebounding | Safe-haven demand |

| Oil | Sideways | Supply-demand uncertainty |

| Crypto | Consolidating | Reduced risk appetite |

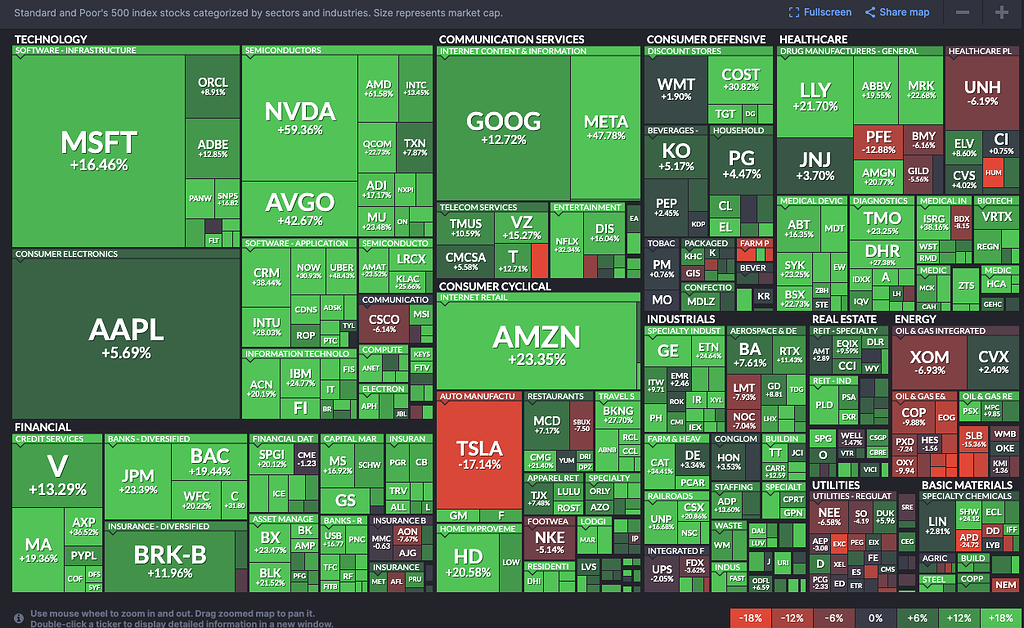

📉 Stock Market Trends

U.S. stock futures are trading modestly higher, suggesting investors are positioning cautiously ahead of key macroeconomic data releases. Market breadth remains balanced, indicating consolidation rather than a broad breakout. Defensive sectors and selective technology stocks continue to attract attention, while high-beta names remain sensitive to interest rate expectations.

European equities are mixed, with some pressure visible in major indices as investors reassess growth outlooks and sector valuations.

🔹 Equity Market Themes

- Gradual recovery in U.S. futures

- Sector rotation favors defensives and materials

- Volatility remains contained but elevated

- Earnings resilience supporting downside protection

Suggested chart for WordPress:

📊 S&P 500 Daily Price Chart with 50 & 200 MA

💱 Forex Market Outlook

The foreign exchange market continues to favor the U.S. dollar as traders price in interest rate expectations and upcoming U.S. economic releases. Major currency pairs remain technically driven, with volatility expected to rise around scheduled data.

🔹 Major Currency Performance

| Currency Pair | Bias | Key Insight |

|---|---|---|

| EUR/USD | Neutral-Bearish | Pressure from USD strength |

| GBP/USD | Range-Bound | Awaiting economic clarity |

| USD/JPY | Bullish | Yield differentials favor USD |

| AUD/USD | Resilient | Commodity support |

Forex traders are closely watching PMI data, employment figures, and central bank commentary, all of which could influence short-term direction.

Suggested chart:

📊 USD Index (DXY) vs EUR/USD Comparison

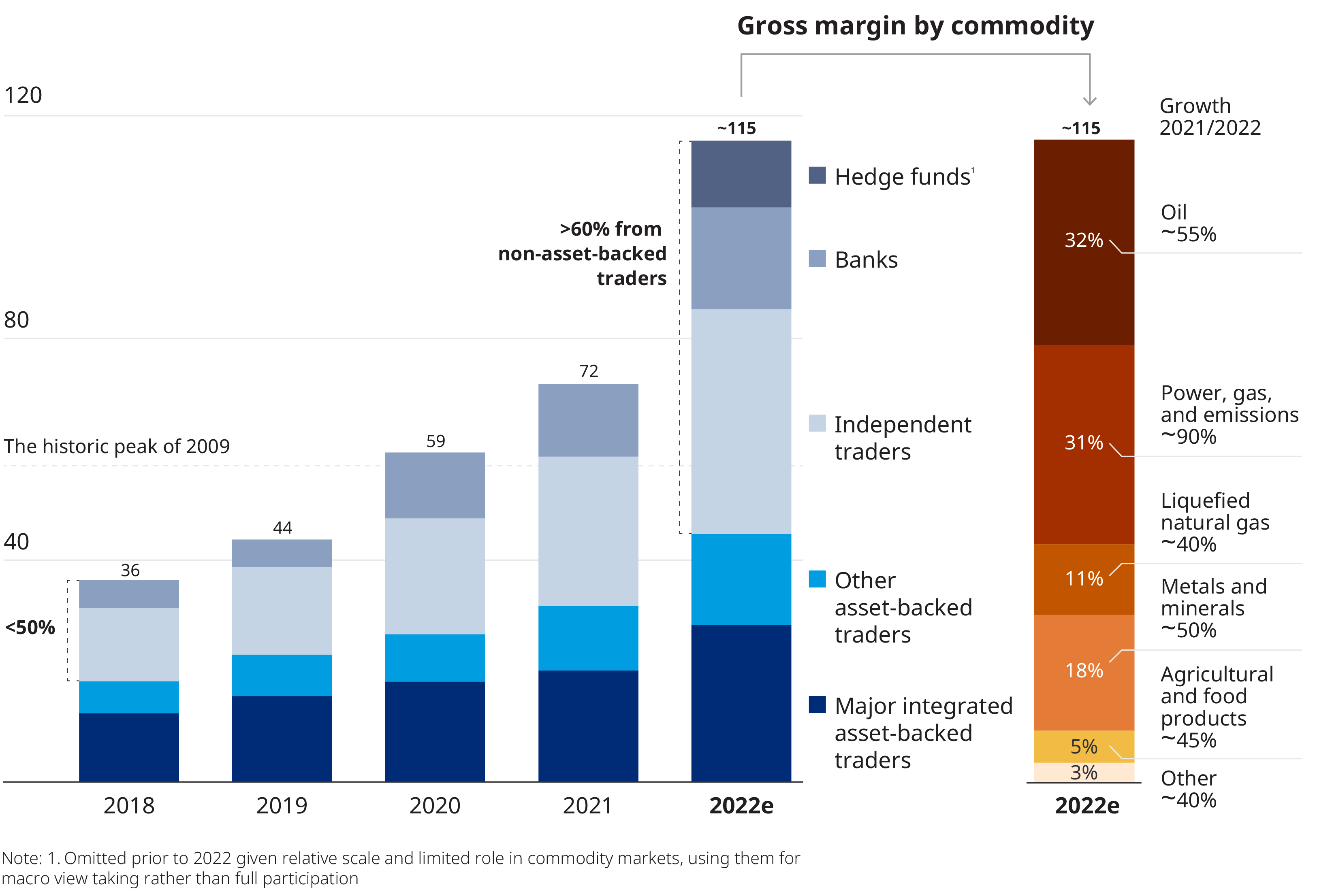

🛢 Commodities Market Update

Commodities are showing mixed signals. Gold has staged a rebound as investors seek protection amid uncertainty, while oil prices remain sensitive to geopolitical developments and global demand expectations.

🔹 Commodities Snapshot

| Commodity | Trend | Driver |

|---|---|---|

| Gold | Rebounding | Safe-haven demand |

| Silver | Volatile | Industrial + defensive demand |

| Crude Oil | Range-Bound | Supply-demand balance |

| Natural Gas | Soft | Seasonal demand shift |

Gold’s technical structure suggests short-term stabilization, while oil remains trapped within a broader consolidation range.

Suggested chart:

📊 Gold Price vs US Treasury Yields

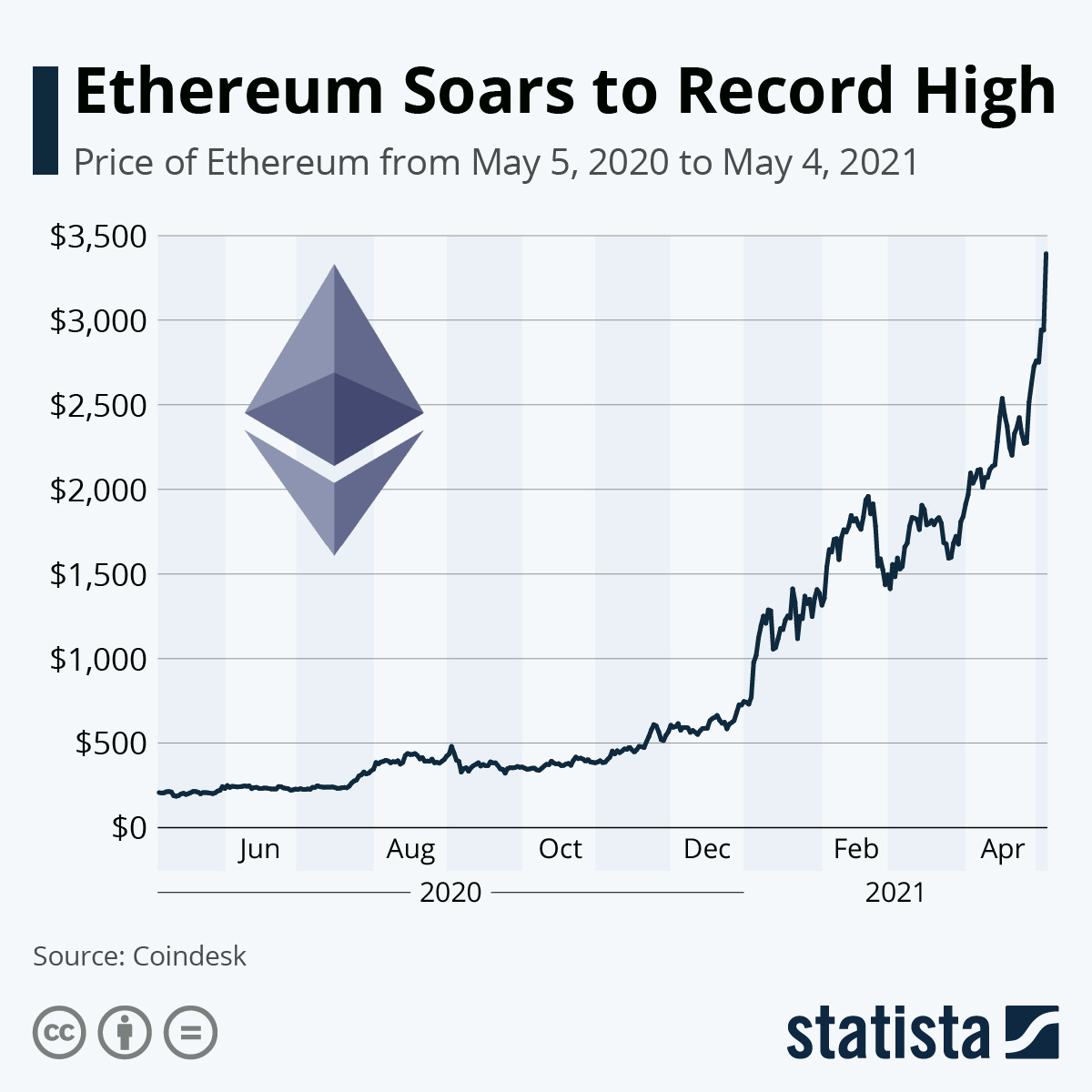

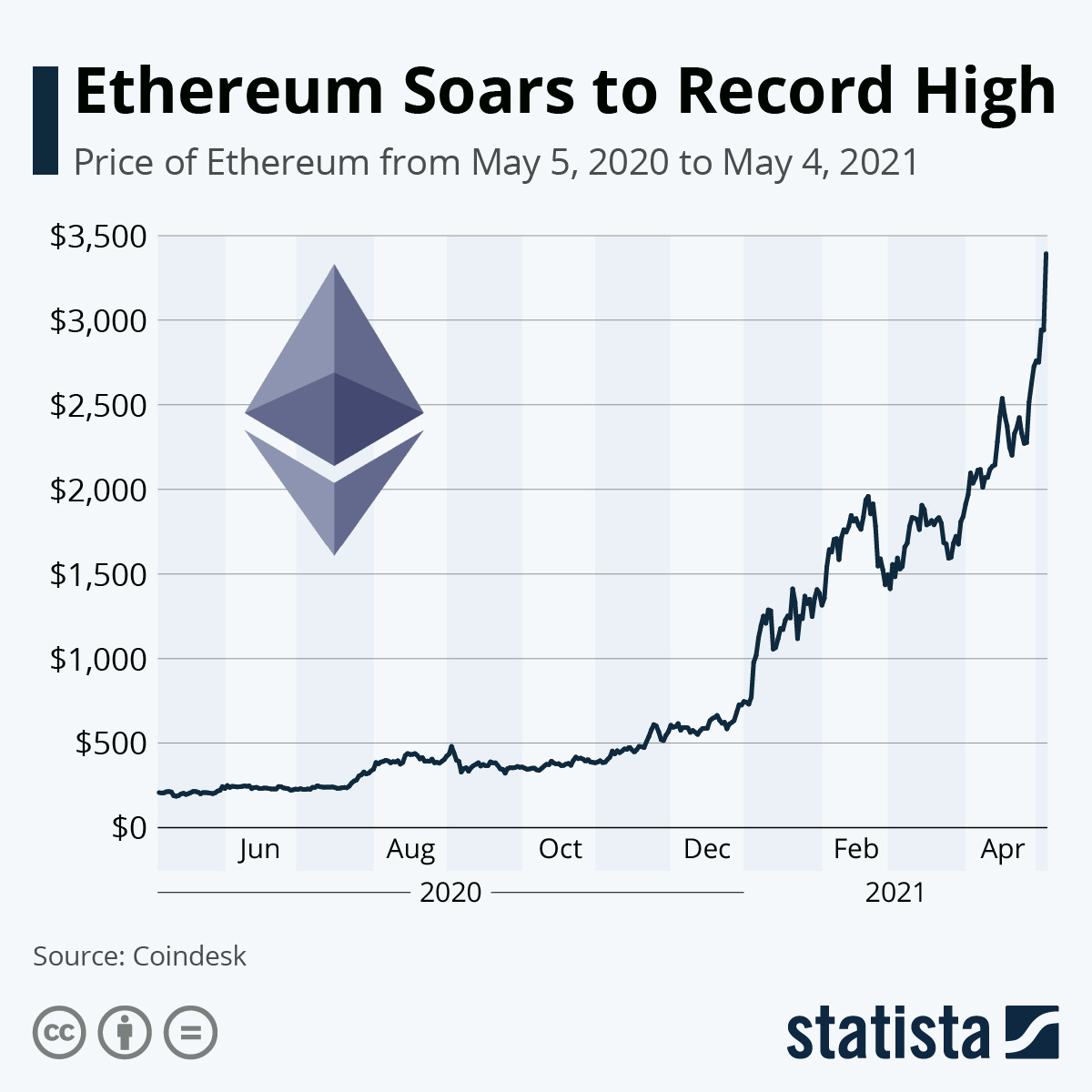

🪙 Cryptocurrency Market Overview

Cryptocurrency markets remain subdued, with Bitcoin and major altcoins consolidating below recent highs. Reduced volatility suggests traders are waiting for clearer macro direction before committing to new positions.

🔹 Crypto Market Highlights

- Bitcoin remains range-bound

- Altcoins underperform relative to BTC

- Market sentiment cautious

- Macro conditions dominating price action

Suggested chart:

📊 Bitcoin Daily Chart with Key Support & Resistance

📆 Key Economic Events to Watch

High-impact economic releases scheduled this week could influence all asset classes:

- Services PMI (Europe & US)

- U.S. employment data

- Central bank speeches

- Crude oil inventory reports

These events are expected to drive short-term volatility in forex, equities, and commodities.

🔮 Short-Term Market Outlook (Next 24–72 Hours)

Markets are likely to remain range-bound with episodic volatility driven by economic data and sentiment shifts.

Bullish risks:

- Strong macro data

- Stable earnings outlook

- Continued safe-haven demand

Bearish risks:

- Hawkish policy signals

- Unexpected inflation surprises

- Geopolitical escalation

Traders are advised to manage risk carefully, watch key technical levels, and remain flexible as data unfolds.

Global financial markets are navigating a mixed but opportunity-rich environment as investors react to economic data, central bank expectations, and shifting risk sentiment. From equities and forex to commodities and crypto, today’s market action reflects cautious positioning ahead of key macroeconomic catalysts.

This Daily Global Market Trends report delivers a comprehensive, data-driven overview of global markets to help traders, investors, and analysts stay ahead.

📌 Featured Image Prompt (WordPress Cover Image)

Prompt for AI or Stock Image:

“Global financial markets concept showing stock charts, forex candlesticks, gold bars, oil barrels, and Bitcoin symbols on a digital world map, professional financial newsroom style, dark blue background, high contrast, 16:9 ratio.”

Alt text (SEO):

Global market trends across stocks, forex, commodities, and crypto

📊 Executive Market Summary

Markets opened with cautious optimism as U.S. equity futures edged higher, the U.S. dollar maintained strength, and commodities remained volatile. Investors are closely watching upcoming economic data that could shape short-term direction across all asset classes.

Today’s highlights:

- U.S. stocks show mild upside momentum

- USD strength persists in forex markets

- Gold rebounds on safe-haven demand

- Oil trades sideways amid uncertainty

- Crypto markets consolidate under risk-off sentiment

📈 Market Snapshot (All Asset Classes)

| Asset Class | Trend | Primary Driver |

|---|---|---|

| U.S. Stocks | Mildly Bullish | Earnings stability, macro anticipation |

| European Stocks | Mixed | Sector rotation |

| Forex (USD) | Strong | Rate expectations |

| Gold | Rebounding | Risk hedging |

| Oil | Range-Bound | Supply-demand balance |

| Crypto | Consolidating | Macro uncertainty |

📉 Stock Market Trends

U.S. equity futures are trading modestly higher as investors position ahead of key economic releases. Market breadth suggests consolidation rather than a breakout, with defensive sectors attracting steady inflows.

European equities remain mixed, reflecting cautious sentiment and selective profit-taking.

Recurring Chart Template (Daily):

- S&P 500 daily chart (50 & 200 MA)

- Nasdaq Composite momentum view

- Finviz sector heatmap snapshot

💱 Forex Market Outlook

The forex market continues to favor the U.S. dollar as traders price in interest-rate differentials and upcoming macro data. Volatility is expected to increase around scheduled economic events.

| Pair | Bias | Commentary |

|---|---|---|

| EUR/USD | Neutral-Bearish | USD pressure dominates |

| GBP/USD | Range-Bound | Awaiting catalysts |

| USD/JPY | Bullish | Yield spread advantage |

| AUD/USD | Neutral | Commodity support |

Recurring Chart Template:

- DXY vs EUR/USD comparison

- USD/JPY trend channel

- ForexFactory high-impact events overlay

🛢 Commodities Market Update

Commodities are sending mixed signals. Gold is rebounding as investors seek safety, while oil remains locked in consolidation due to demand uncertainty and geopolitical risk.

| Commodity | Trend | Key Factor |

|---|---|---|

| Gold | Rebounding | Safe-haven flows |

| Silver | Volatile | Dual demand |

| Crude Oil | Sideways | Inventory & geopolitics |

| Natural Gas | Soft | Seasonal demand |

Recurring Chart Template:

- Gold vs US Treasury yields

- Brent crude daily range map

🪙 Cryptocurrency Market Overview

Crypto markets remain subdued, with Bitcoin and major altcoins consolidating below recent highs. Macro conditions continue to dictate sentiment.

Recurring Chart Template:

- Bitcoin support/resistance zones

- BTC dominance vs altcoins

📆 Key Economic Events to Watch

High-impact events this week include:

- PMI data (US & Europe)

- Employment figures

- Central bank speeches

- Crude oil inventory reports

Track the full calendar on ForexFactory:

👉 https://www.forexfactory.com/

🔮 Short-Term Market Outlook (24–72 Hours)

Markets are likely to remain range-bound with data-driven volatility.

Upside risks:

- Positive economic surprises

- Stable earnings outlook

Downside risks:

- Hawkish policy signals

- Inflation surprises

- Geopolitical escalation

Suggested internal anchors:

- Daily Market Analysis

- Forex Trading Insights

- Stock Market News

- Crypto Market Updates

- Economic Calendar Explained

- www.checkthetrend.com

Other Global updates:

Remote Work Trends in Africa 2026: Opportunities, Tools & Challenges

Watch Live Football Online: The Complete Global Guide for Soccer Fans

2025 Nail Trends: What’s Hot in Manicure Fashion