🌍 Daily Global Market Trends

Updated: Today

Global financial markets are navigating a mixed and volatile environment as investors respond to tech-sector weakness, resilient services data, shifting inflation expectations, and upcoming central bank decisions. Sector rotation, currency movements, and safe-haven demand are defining today’s trading landscape across asset classes.

📊 Executive Market Summary

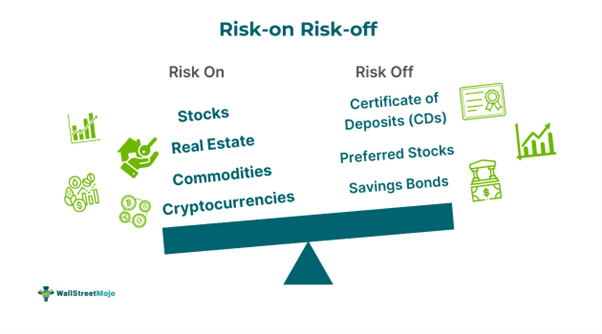

Markets are showing divergent performance globally. Technology stocks are under pressure, traditional sectors are gaining favor, and safe-haven assets such as gold are rebounding. Forex markets reflect cautious positioning ahead of central bank announcements, while cryptocurrencies remain subdued under broader risk-off sentiment.

Key themes today:

- Tech-led volatility in U.S. equities

- Sector rotation into defensives

- USD strength in forex markets

- Gold stabilizing as a safe haven

- Crypto consolidating below key levels

📈 Global Equity Markets Overview

Global stock markets are experiencing uneven performance as investors rebalance portfolios. U.S. indices show pressure from technology stocks, while European markets benefit from strength in financials and industrials.

Major Index Snapshot

| Index | Trend | Market Insight |

|---|---|---|

| Dow Jones | Slightly Higher | Rotation into value stocks |

| NASDAQ | Under Pressure | Tech sell-off |

| FTSE 100 | Firm | Defensive sectors |

| DAX | Mixed | Export sensitivity |

| CAC 40 | Positive | Financial strength |

Investors remain focused on earnings durability and macroeconomic resilience.

👉 Related: Sector Rotation Explained

https://www.checkthetrend.com/sector-rotation-analysis/

🧠 What’s Driving Stocks Today

🔹 Tech Sector Volatility

Software and high-growth technology stocks are under renewed pressure amid concerns about AI-driven disruption, valuation resets, and earnings sustainability.

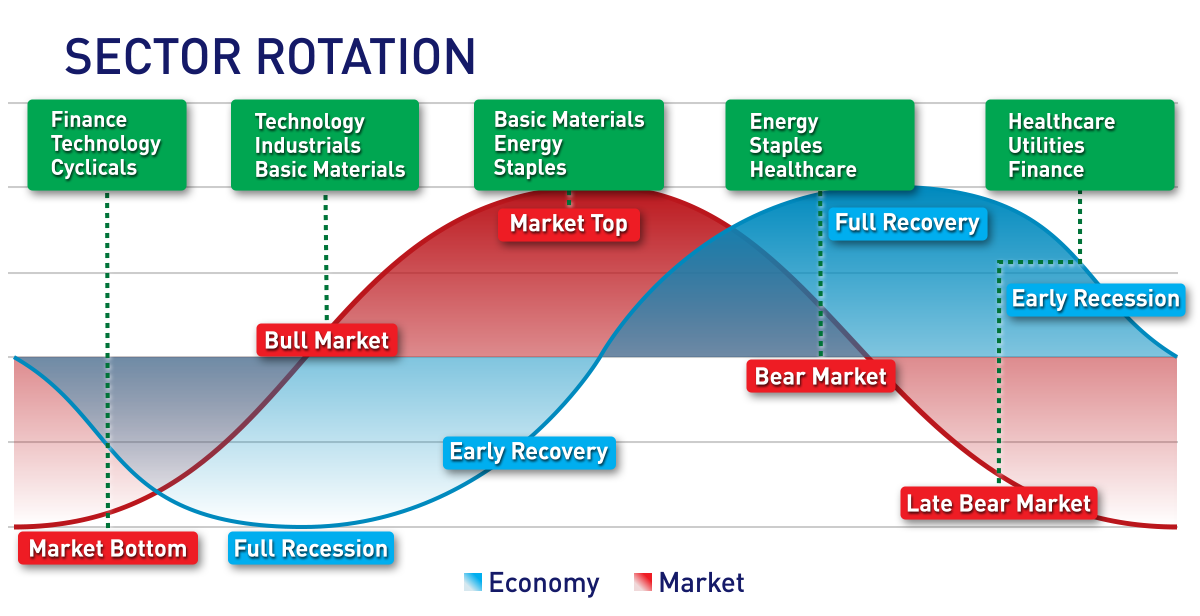

🔹 Sector Rotation

Capital continues flowing into:

- Financials

- Industrials

- Consumer staples

- Energy

This rotation reflects a shift toward stability and cash flow over high-growth narratives.

💱 Forex Market Outlook

Currency markets remain sensitive to macro data and central bank expectations.

Currency Trends

- USD: Strengthening on safe-haven demand

- EUR: Pressured ahead of ECB guidance

- GBP: Volatile before BoE signals

- JPY: Weak amid yield differentials

Forex traders are closely monitoring policy commentary and inflation indicators.

👉 Learn more: Forex Trading Strategies

https://www.checkthetrend.com/forex-trading-strategies/

🛢 Commodities & Safe Havens

Precious Metals

Gold has rebounded as investors seek protection amid equity volatility and macro uncertainty. Silver remains more volatile than gold due to its industrial demand exposure.

Energy Markets

Oil prices remain range-bound as traders weigh geopolitical supply risks against softer demand expectations.

👉 Deep dive: Commodity Market Trends

https://www.checkthetrend.com/commodity-market-trends/

🪙 Cryptocurrency Market Update

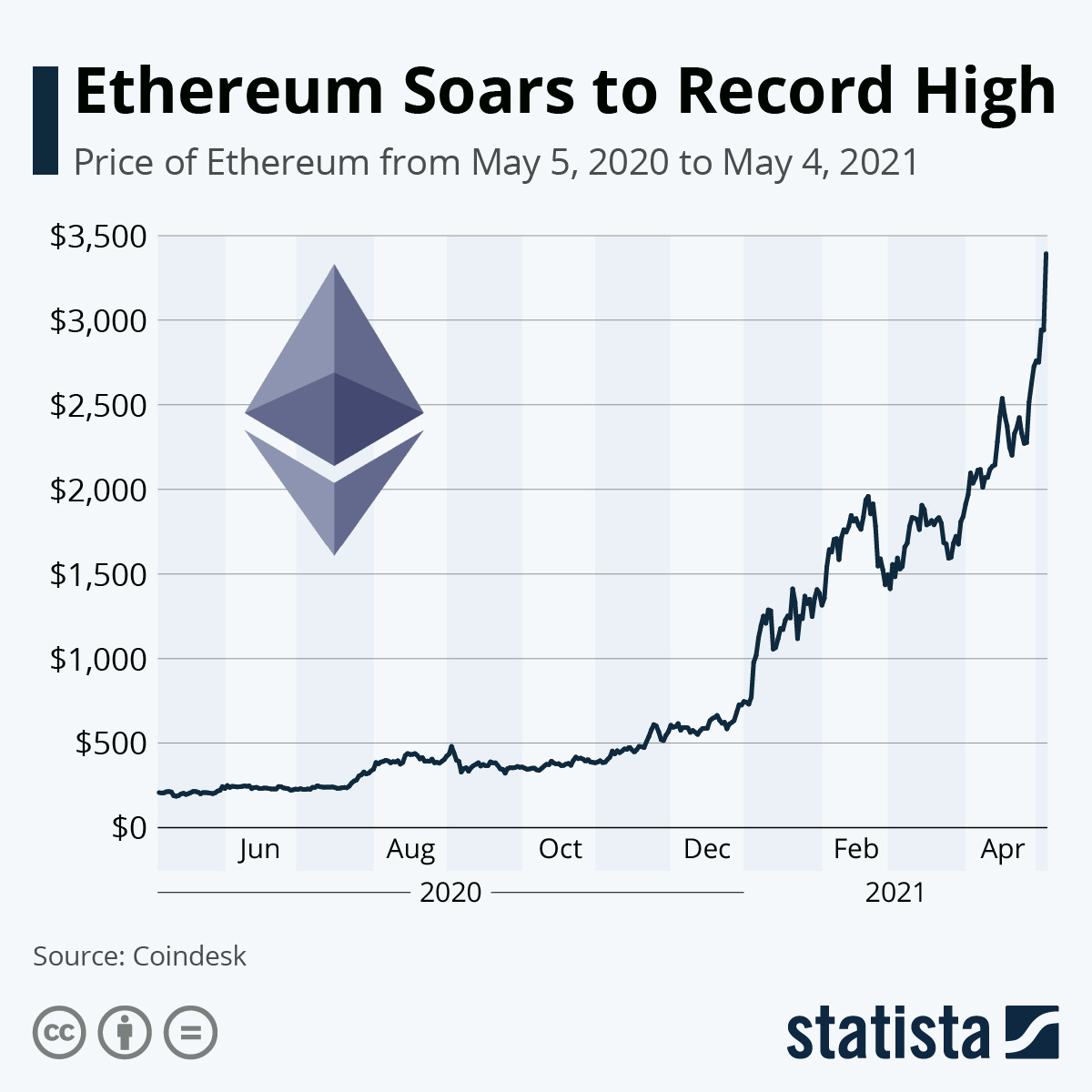

Digital assets continue to consolidate following recent sell-offs.

- Bitcoin: Struggling to reclaim key resistance

- Ethereum: Tracking broader market sentiment

- Altcoins: Mixed recovery attempts

Crypto markets remain highly sensitive to macroeconomic developments and liquidity conditions.

👉 Related: Crypto Market Trends Explained

https://www.checkthetrend.com/crypto-market-trends/

📉 Market Sentiment & Volatility

Volatility indicators suggest persistent caution. Traders are reducing exposure to risk assets while awaiting clarity from economic data and central bank signals.

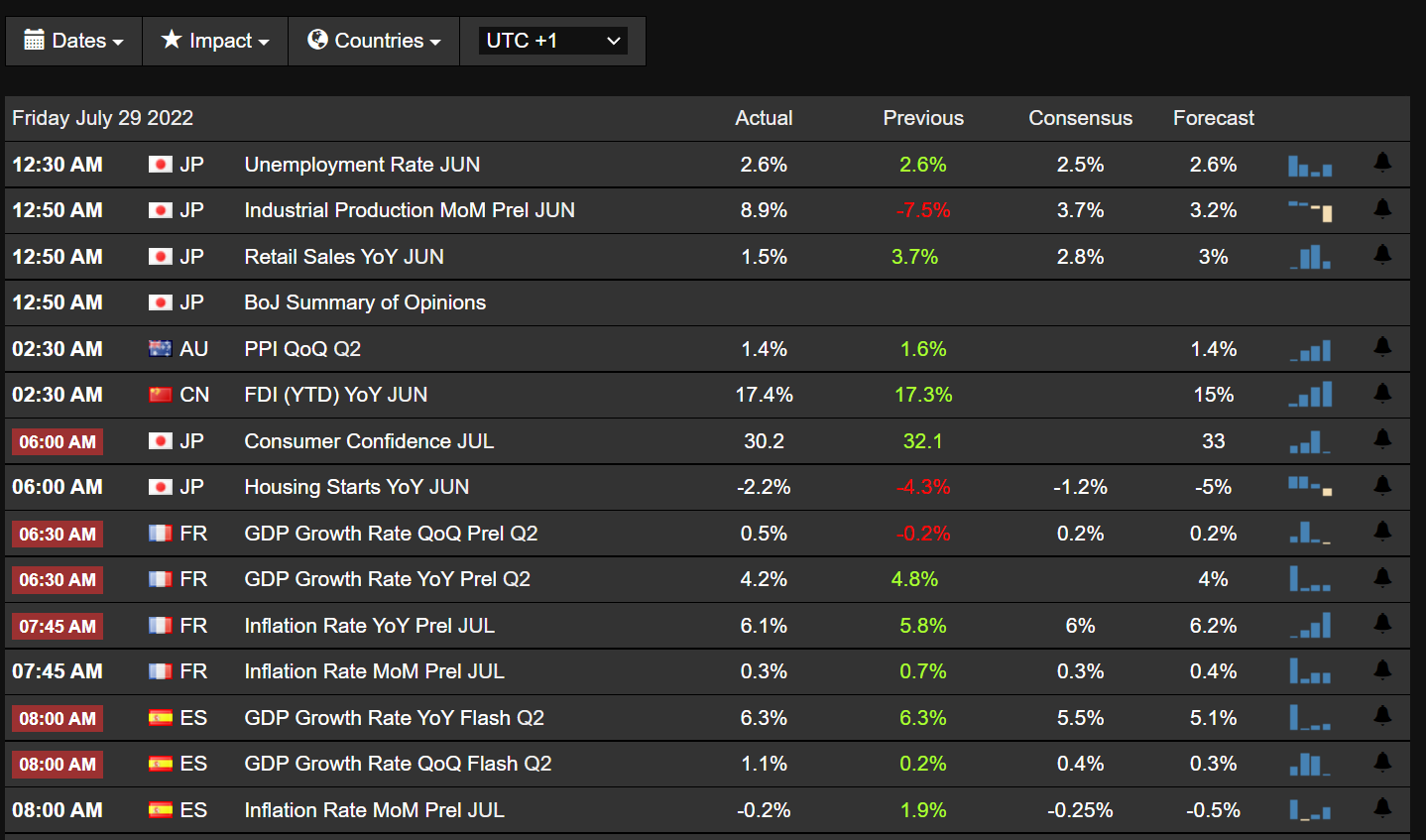

📆 Key Economic Events to Watch

Markets are focused on:

- Central bank policy announcements

- Inflation and employment data

- Services and manufacturing PMI

- Commodity inventory reports

These events are likely to shape near-term volatility across all markets.

🔮 Short-Term Market Outlook (24–72 Hours)

Markets are expected to remain range-bound with spikes in volatility around major economic releases.

Bullish drivers:

- Strong services data

- Sector rotation support

- Safe-haven demand

Bearish risks:

- Hawkish policy signals

- Tech earnings pressure

- Geopolitical uncertainty

Traders should prioritize risk management and monitor key technical levels closely.

📌 Final Takeaway

Today’s global market trends highlight a landscape shaped by volatility, rotation, and caution. While growth sectors face pressure, defensive assets and safe havens are regaining favor. As macro events unfold, disciplined strategies and diversification remain essential.

🔗 Recommended Reading

- Market Analysis Tools

https://www.checkthetrend.com/market-analysis-tools/ - Risk Management Strategies

https://www.checkthetrend.com/risk-management-strategies/