🌍 Global Market Trends Today: Stocks, Forex, Commodities & Investor Sentiment (Feb 6, 2026)

Prompt:

“Global financial markets dashboard showing stock charts, forex currency pairs, and world map overlays, modern fintech style, dark background, high contrast”

🧭 Introduction: Why Global Markets Matter Today

Global financial markets today are navigating a complex mix of equity volatility, currency repositioning, and shifting investor sentiment. From U.S. stock movers to forex reactions triggered by economic data releases, today’s market activity reflects deeper macroeconomic adjustments unfolding in early 2026.

This comprehensive guide breaks down global market trends today using insights from:

- MSN Markets (most active stocks)

- ForexFactory (economic calendar & currency impact)

- Finviz (technical scanners & market heatmaps)

Global financial markets today are operating in a highly interconnected and fast-reacting environment, where movements in one asset class can quickly cascade across others. Equity volatility, currency repositioning, and shifting investor sentiment are no longer isolated events—they are signals of broader macroeconomic realignments taking shape in early 2026.

What makes today’s market landscape especially important is the speed and sensitivity of reactions. A single economic data release, central bank comment, or geopolitical headline can instantly influence:

- Stock prices across global exchanges

- Currency strength and capital flows

- Commodity pricing and inflation expectations

From U.S. stock movers reacting to earnings and sector rotation, to forex markets responding in real time to inflation data and interest-rate expectations, today’s market behavior reflects investors continuously reassessing risk, growth, and valuation.

In 2026, markets are being shaped by several overlapping forces:

- Persistent inflation concerns and policy uncertainty

- Diverging central bank strategies across regions

- Increased algorithmic and short-term trading activity

- Heightened sensitivity to macroeconomic signals

This means that understanding why markets move today is just as important as knowing what is moving.

📌 How This Guide Helps You Navigate Today’s Markets

This comprehensive guide breaks down global market trends today using a multi-layered, data-driven approach. Rather than focusing on headlines alone, it combines real-time activity, economic context, and technical signals to give a clearer picture of market direction and risk.

We draw insights from three widely trusted market intelligence platforms:

- MSN Markets — to track most active stocks, sector momentum, and broad equity participation. This helps identify where trading volume and investor attention are concentrated at any given moment.

- ForexFactory — to interpret the economic calendar and currency impact, highlighting which macroeconomic releases and central bank events are driving volatility in the forex market.

- Finviz — to analyze technical scanners, heatmaps, and market breadth, offering visual confirmation of strength, weakness, and emerging trends across stocks and sectors.

By combining these perspectives, this guide helps investors, traders, and market watchers:

- Understand current market sentiment (risk-on vs. risk-off)

- Identify key drivers behind price movements

- Anticipate potential volatility and near-term risks

- Make more informed decisions in a rapidly changing global market environment

In short, today’s global markets matter because they are not just reflecting isolated events—they are pricing in expectations about growth, inflation, policy, and risk for the months ahead. This guide is designed to help you read those signals clearly and stay one step ahead.

📊 Global Stock Market Overview

🔹 U.S. Equity Market Snapshot

Markets today show mixed performance with elevated intraday volatility:

Key observations:

- Tech stocks stabilizing after sell-offs

- Small-cap volatility increasing

- Sector rotation favoring value & international equities

📌 Most active stocks today can be tracked live on MSN Markets

👉 Microsoft Market News

📈 Top Gainers (Momentum Plays)

- LIMN (+40%+)

- CISS (+28%+)

- ESLA (+26%+)

These names show high relative volume and breakout confirmations on Finviz scanners.

📉 Major Decliners

- DXST (-60%+)

- CLGN (-50%+)

- OBAI (-40%+)

Sharp drops reflect risk repricing in speculative assets.

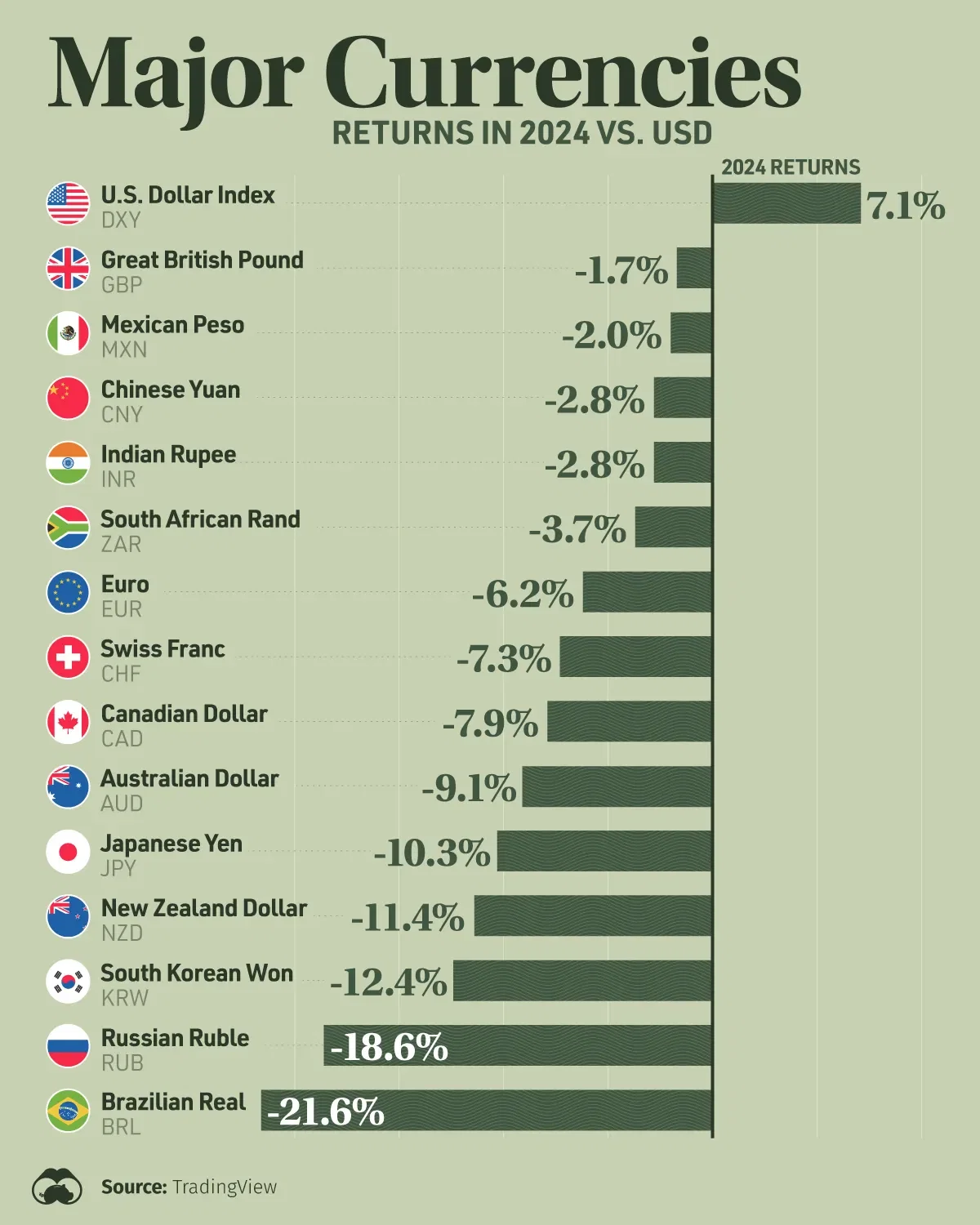

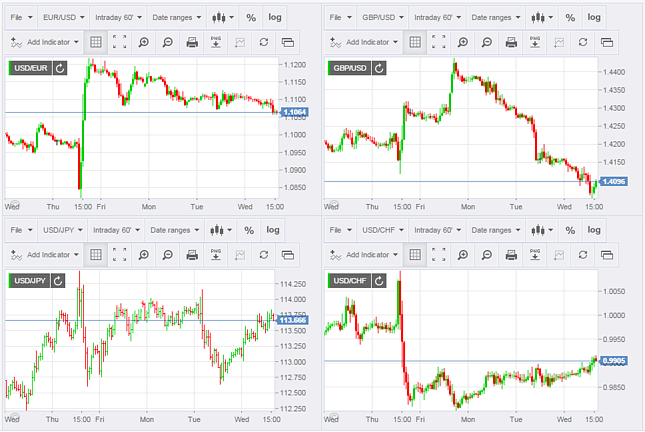

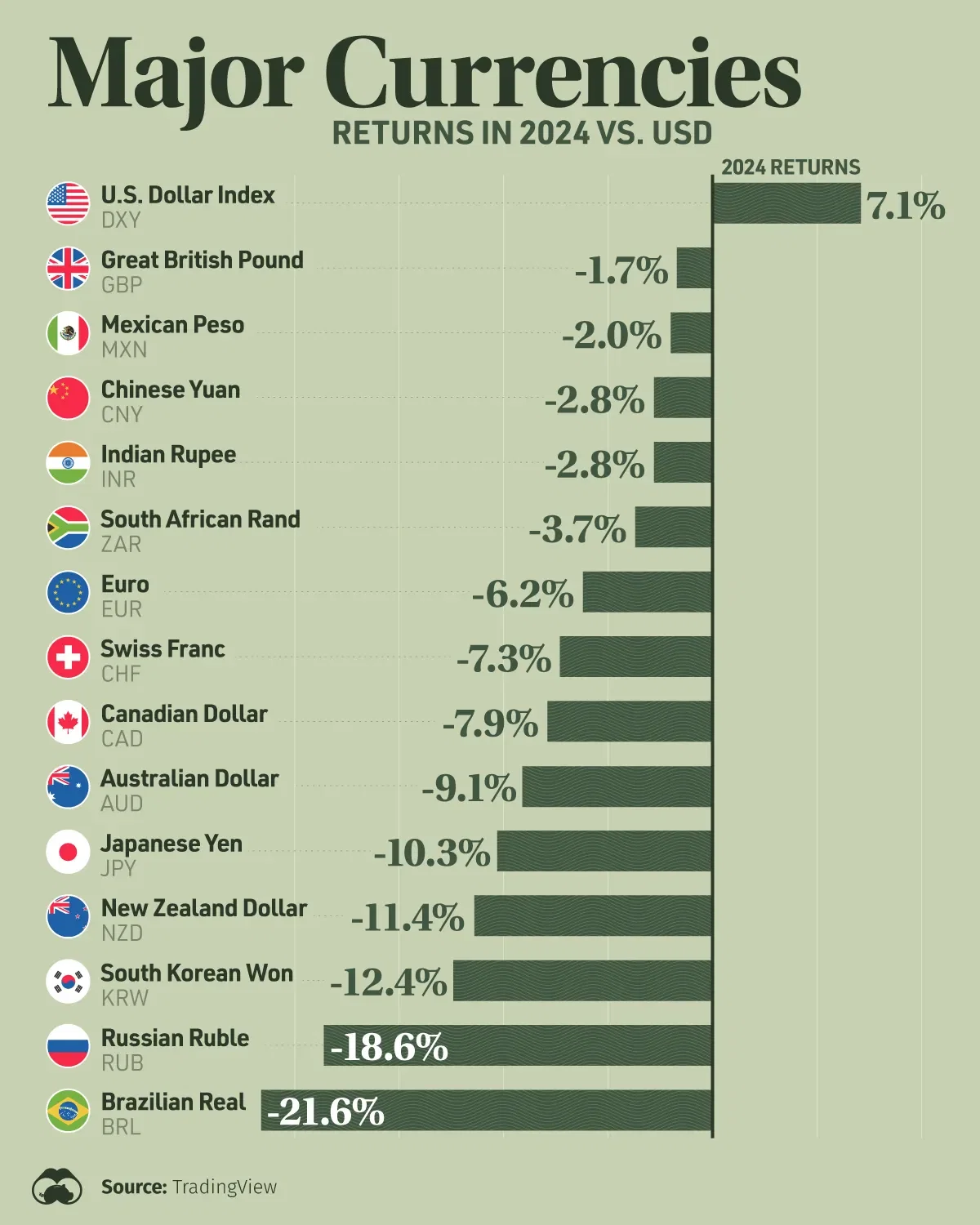

💱 Forex Market Trends Today

🔹 Major Currency Movements

| Pair | Daily Trend |

|---|---|

| AUD/USD | ▲ Strong |

| NZD/USD | ▲ Bullish |

| EUR/USD | ➖ Neutral |

| USD/JPY | ➖ Flat |

| GBP/JPY | ▲ Volatile |

📌 This confirms risk-on behavior as traders favor higher-yield currencies.

📅 Economic Catalysts (ForexFactory)

Live economic data impacting today’s forex market:

- European industrial output data

- UK housing indicators

- Inflation expectations

ALT text:Forex heatmap showing major currency strength today

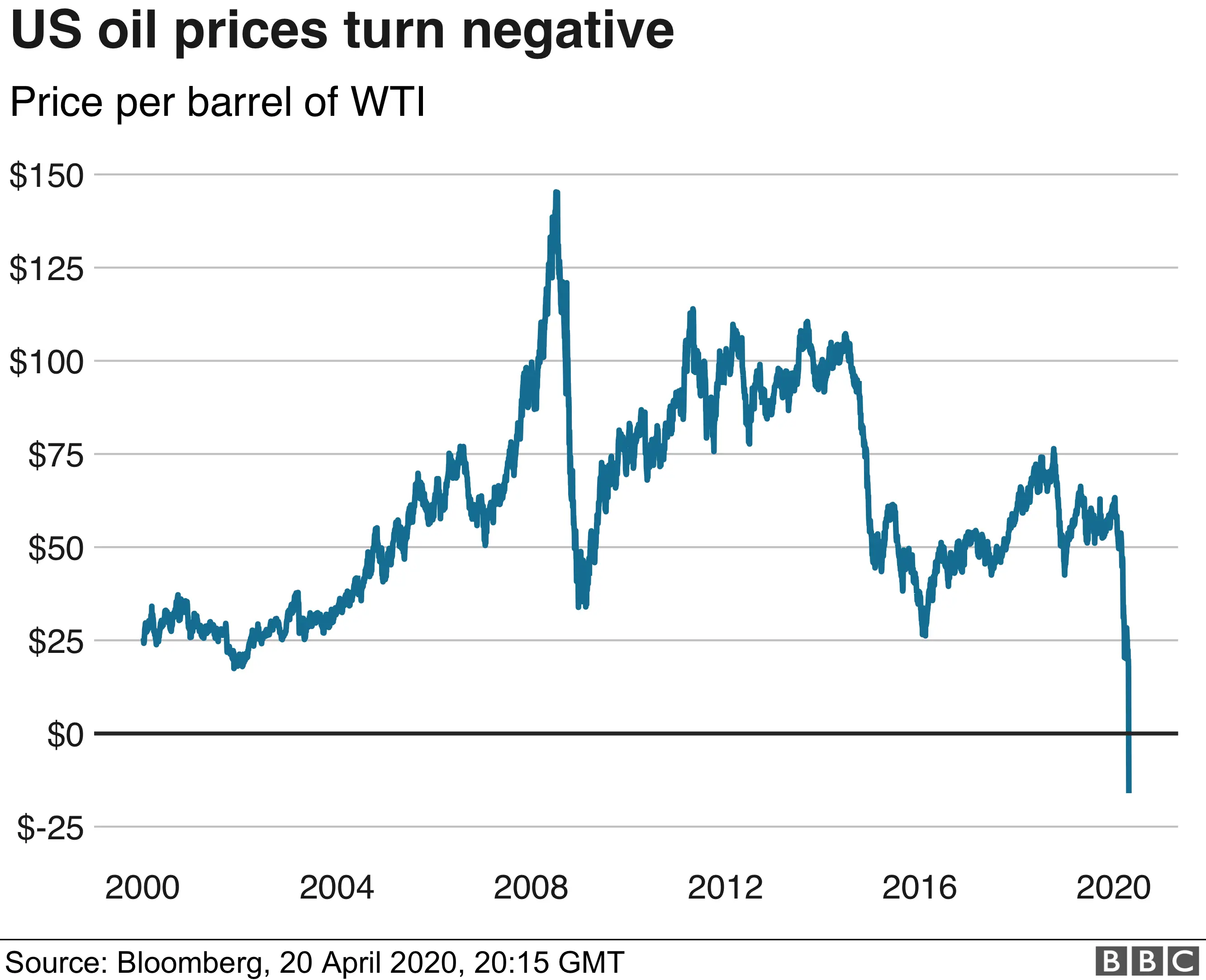

🛢️ Commodities Market Trends

🔹 Commodity Highlights

- Gold: Stable amid rising volatility

- Oil: Demand uncertainty persists

- Commodities overall: Acting as inflation hedges

🧠 Market Sentiment & Technical Indicators

📉 Breadth & Volatility

- Decliners outnumber advancers

- Volatility spikes in mid-caps

- Heavy algorithmic trading visible

🔍 Finviz Technical Signals

- Head-and-shoulders patterns increasing

- Breakout failures in overextended stocks

- Accumulation in international ETFs

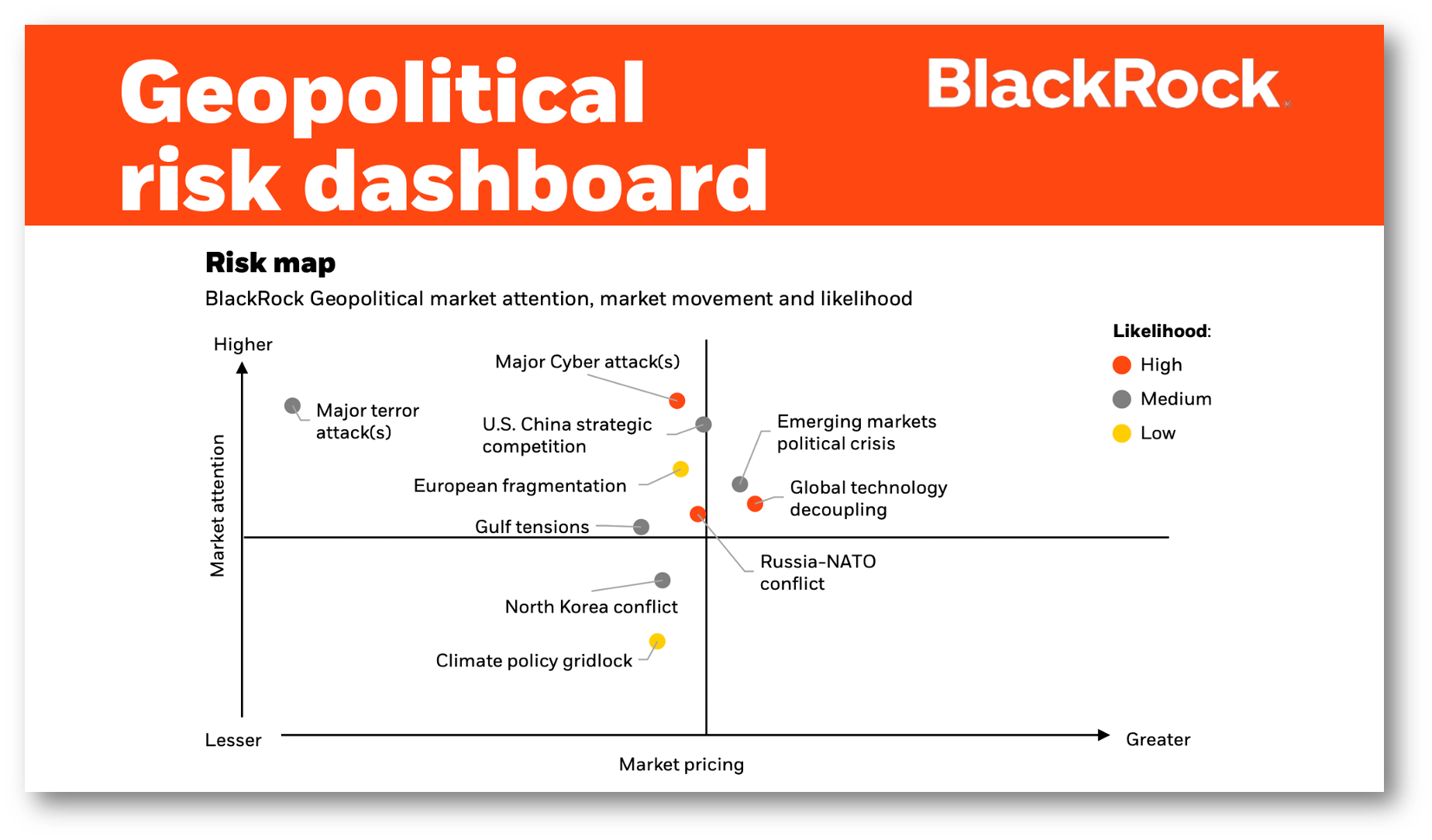

🌍 Global Market Drivers in 2026

🔹 Macro Trends

- Capital rotation outside U.S. equities

- Higher interest-rate normalization

- Increased geopolitical risk pricing

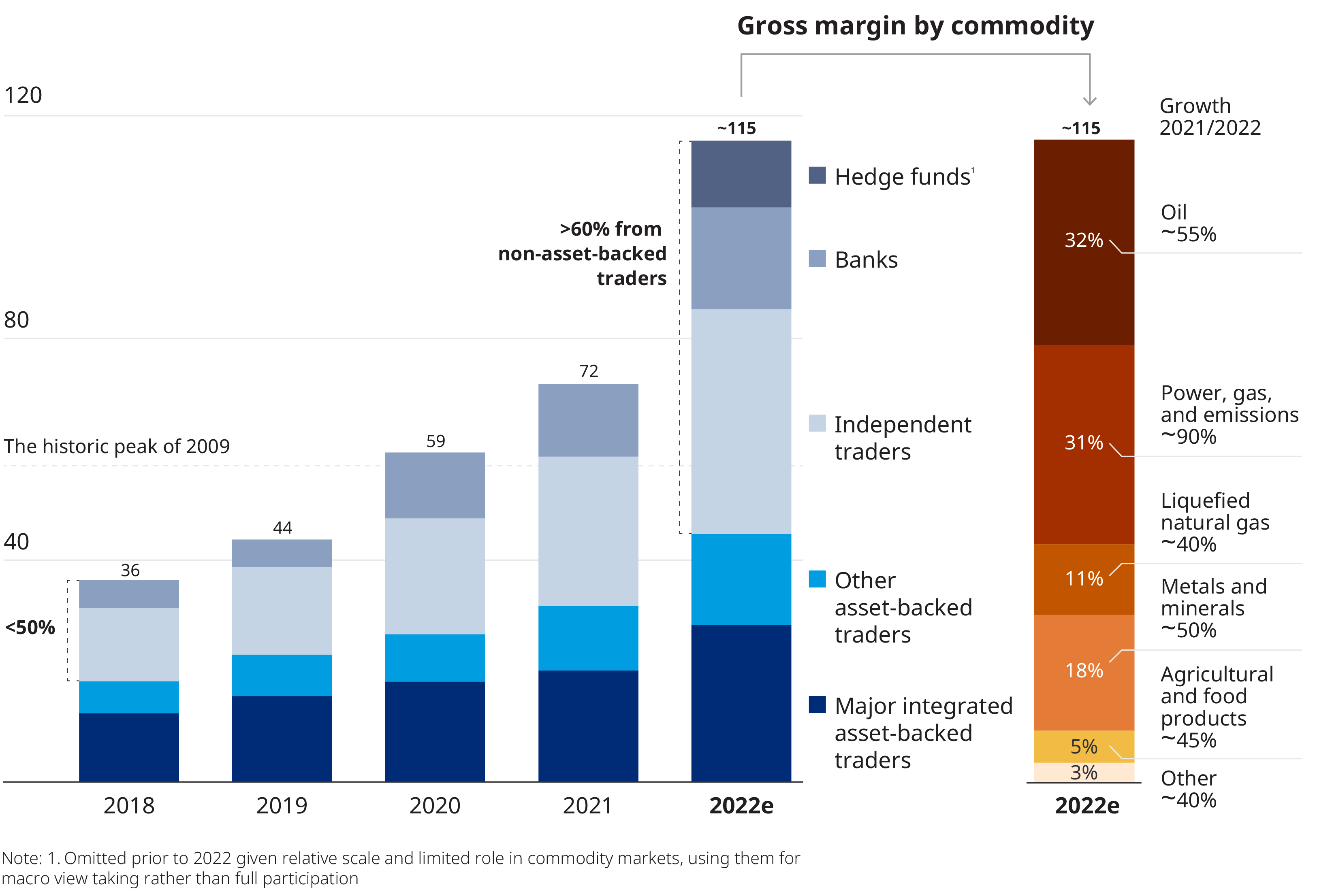

🔹 Institutional Signals

- Hedge funds reducing exposure to overvalued growth stocks

- Increased interest in dividend and international ETFs

⚠️ Market Risks to Monitor

- Central bank policy surprises

- Currency volatility affecting earnings

- Commodity supply disruptions

- Earnings guidance downgrades

⚠️ Market Risks to Monitor

Understanding today’s market risks is critical for navigating volatility and protecting capital. Below is a deeper breakdown of the four key risk factors currently shaping global markets—and how they tend to ripple across stocks, forex, and commodities.

🏦 Central Bank Policy Surprises

Central banks remain the single most powerful market movers. Even subtle changes in tone can trigger sharp reactions across asset classes.

Why this matters

- Unexpected rate hikes or cuts can reprice equities and bonds within minutes.

- Forward guidance shifts (hawkish vs. dovish language) often move markets more than the decision itself.

- Policy divergence between major central banks can accelerate capital flows into or out of specific regions.

Market impact

- Stocks: Sudden sell-offs in rate-sensitive sectors (tech, real estate, growth stocks).

- Forex: Rapid strengthening or weakening of currencies tied to interest-rate expectations.

- Bonds: Yield spikes or collapses that spill into equity volatility.

What to watch

- Central bank meeting days

- Inflation and labor data ahead of policy decisions

- Changes in wording during press conferences

💱 Currency Volatility Affecting Corporate Earnings

Currency fluctuations are an often underappreciated risk—especially for multinational companies.

Why this matters

- A strong domestic currency can reduce overseas revenue when earnings are repatriated.

- A weak currency can increase import costs, squeezing profit margins.

- FX hedging failures can turn stable earnings into negative surprises.

Market impact

- Stocks: Earnings misses driven by FX translation losses.

- Sectors most affected:

- Technology

- Energy

- Consumer goods

- Industrials

- Forex: Volatility increases around earnings seasons and macro releases.

What to watch

- USD strength vs. EUR, JPY, GBP

- Earnings calls mentioning “currency headwinds”

- Companies with high international revenue exposure

🛢️ Commodity Supply Disruptions

Commodity markets are highly sensitive to supply-side shocks, and disruptions can spread risk across the entire market.

Common triggers

- Geopolitical conflicts

- Shipping route disruptions

- Sanctions or trade restrictions

- Extreme weather events

Market impact

- Oil spikes → higher inflation expectations

- Gold rallies → risk-off sentiment

- Agricultural shortages → food price inflation

Why investors care

- Rising commodity prices can force central banks to stay hawkish.

- Higher energy costs pressure corporate margins and consumer spending.

- Volatility in commodities often precedes broader equity corrections.

What to watch

- OPEC announcements

- Geopolitical news in energy-producing regions

- Sudden inventory drawdowns or supply warnings

📉 Earnings Guidance Downgrades

Forward-looking guidance often matters more than past performance—and downgrades can quickly shift market sentiment.

Why this matters

- Guidance reflects management’s expectations of future demand, costs, and macro conditions.

- Downgrades often trigger analyst rating cuts, amplifying downside pressure.

- Broad guidance cuts across sectors can signal economic slowdown.

Market impact

- Individual stocks: Sharp gaps down on earnings day

- Indexes: Increased volatility during earnings season

- Sectors: Contagion effect when peers revise outlooks

What to watch

- Phrases like “uncertain outlook,” “margin pressure,” or “weaker demand”

- Rising input or labor cost warnings

- Clusters of guidance cuts within the same industry

🔍 Big Picture Takeaway

These risks rarely act in isolation. In many cases:

- Commodity spikes → fuel inflation fears

- Inflation fears → influence central bank policy

- Policy shifts → drive currency volatility

- Currency moves → impact earnings guidance

Staying ahead means watching how these risks connect, not just tracking them individually.

✅ Conclusion: What Global Market Trends Today Tell Us

Today’s global markets reveal a transition phase, not a collapse. While volatility remains elevated, opportunities exist in:

- Forex momentum

- Select equity breakouts

- Defensive commodities

Investors who track real-time data and technical confirmations are best positioned in this environment.